Luxembourg Becomes First Eurozone Nation with Bitcoin ETF Investment

Luxembourg's sovereign wealth fund invests 1% in Bitcoin ETFs, marking historic milestone for European institutional crypto adoption

Luxembourg's sovereign wealth fund invests 1% in Bitcoin ETFs, marking historic milestone for European institutional crypto adoption

Trump Media files SEC paperwork for Crypto Blue Chip ETF holding Bitcoin, Ethereum, Solana, XRP, and CRO, expanding crypto investment offerings

Bitcoin sets new all-time high above $125,000 as spot ETFs see $3.24 billion weekly inflows amid government shutdown and "Uptober" momentum

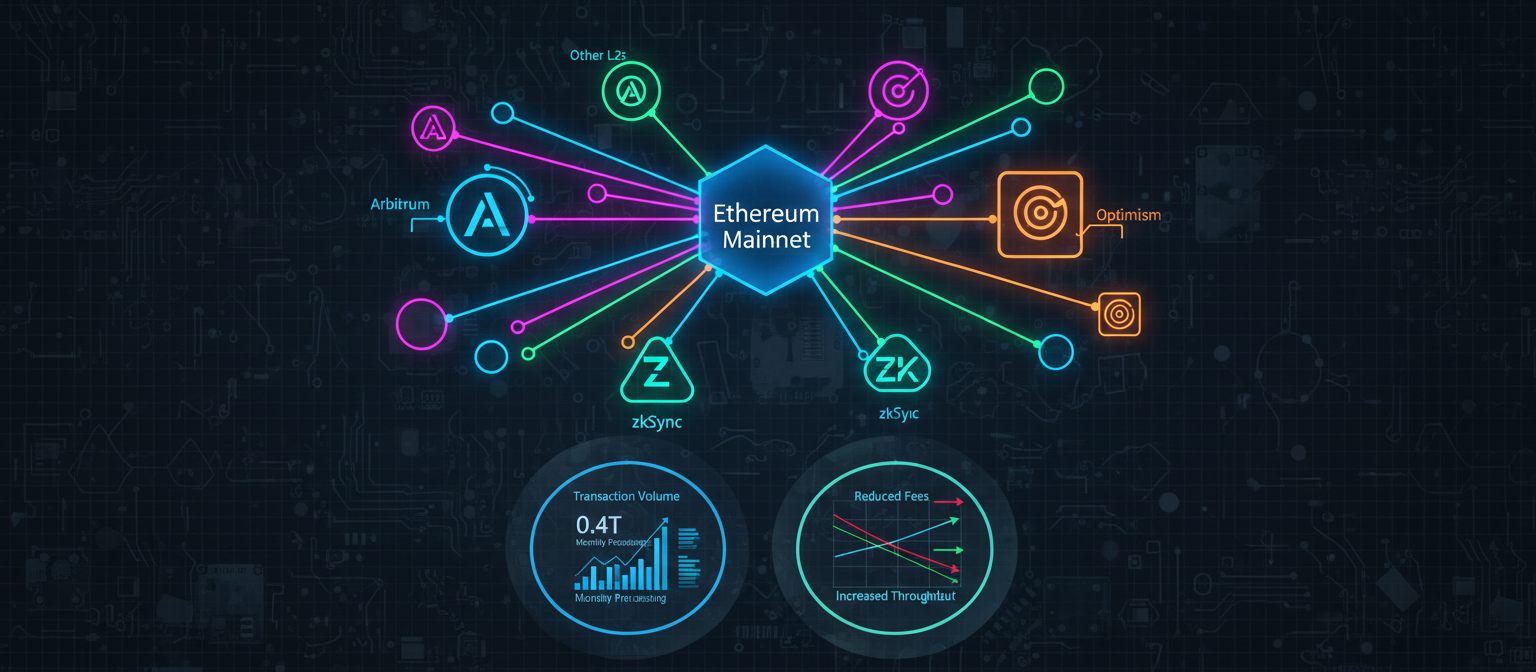

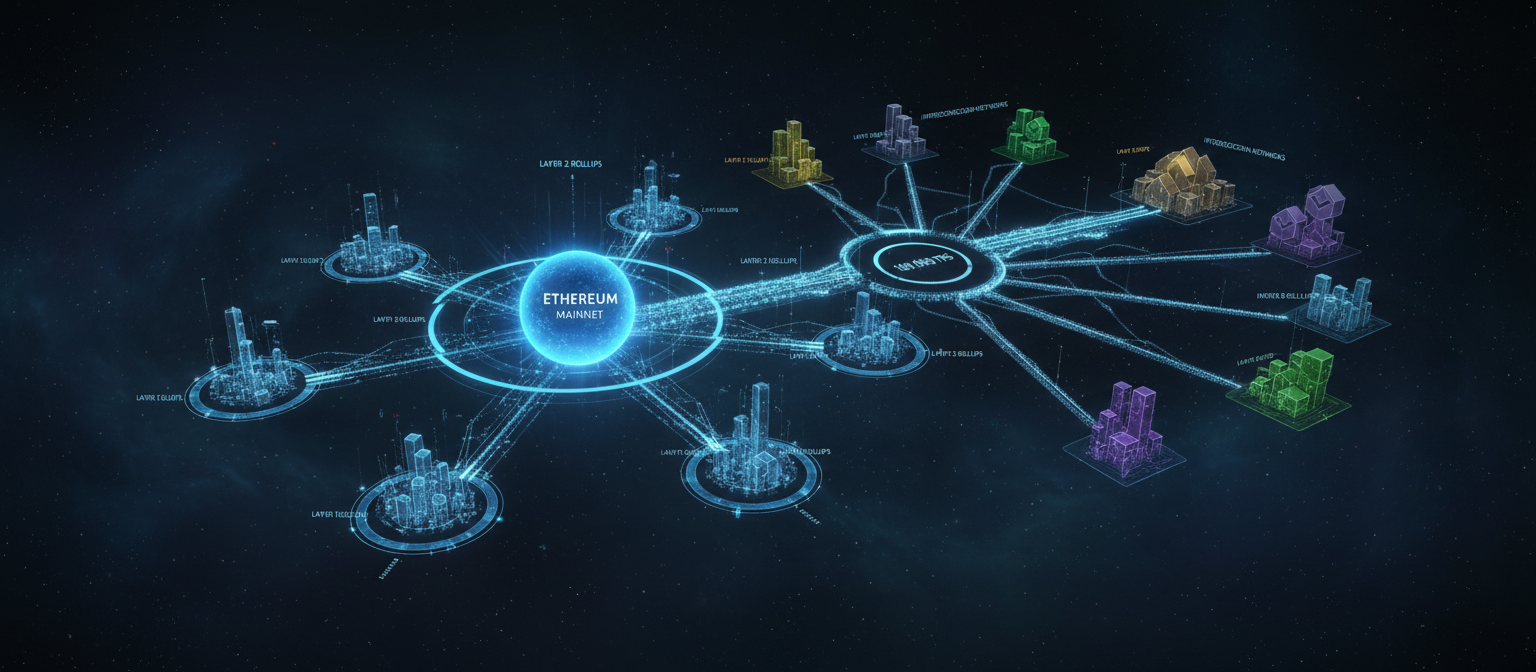

Ethereum Fusaka upgrade introduces PeerDAS to slash Layer-2 costs and boost blob capacity, transforming network into settlement layer for rollups

U.S. spot Bitcoin ETFs attract record $7.1B weekly inflows as institutional investors accelerate cryptocurrency adoption and corporate treasuries embrace digital assets

Ethereum bulls tout AI-driven supercycle potential while Wall Street remains cautious as ETH faces critical resistance at $4,580 with $5,000 year-end target on the line.

Anatoly Yakovenko warns Bitcoin must prepare for quantum computing threats by 2030, proposing migration to quantum-resistant cryptography through network hard fork.

Major Swiss banks successfully conduct cross-bank payment settlement using Ethereum blockchain and deposit tokens in groundbreaking proof-of-concept under Swiss Bankers Association.

SEC streamlines crypto ETF approvals, cutting timeline from 240 days to 60-75 days and opening door for XRP, Solana, and other altcoin funds

Google announces groundbreaking AI agent payments protocol with Coinbase and Ethereum Foundation support, enabling seamless cryptocurrency transactions for AI applications in DeFi ecosystems.

Ethereum Layer-2 networks achieve record $1.4 trillion in monthly transaction volume as scaling solutions mature and institutional adoption accelerates

Ethereum Foundation announces new AI research team led by Davide Crapis to develop decentralized AI infrastructure and ERC-8004 standard for AI agent trust verification.

Ozak AI presale exceeds $2 million raised as investors flock to AI-powered blockchain project promising advanced market predictions and analytics with potential 100x returns.

Decentralized finance total value locked hits 3-year high as Wall Street giants deploy billions into yield farming protocols seeking double-digit returns

Galaxy Digital leads strategic investment in DoubleZero, promising 100,000+ TPS throughput with full Ethereum compatibility and institutional-grade security

Four-year legal battle concludes as SEC and Ripple file joint dismissal, leaving landmark XRP ruling intact and paving way for regulatory clarity

Major financial institutions reclassify cryptocurrency as infrastructure-grade asset, unlocking trillions in potential institutional allocation as operational frameworks mature

BlackRock IBIT reaches $100 billion in assets under management, marking historic milestone for cryptocurrency institutional adoption

Ethereum breaks above $3,400 for first time since January as institutional investors pour record capital into spot ETFs, signaling major shift

Hong Kong launches major consultation on expanding digital asset regulation to cover VA dealers and custodians, implementing comprehensive licensing framework under new policy statement.

Banking giant files $1,150 trademark for JPMD cryptocurrency, piloting USD-denominated deposit token on Coinbase Base blockchain for institutional clients.

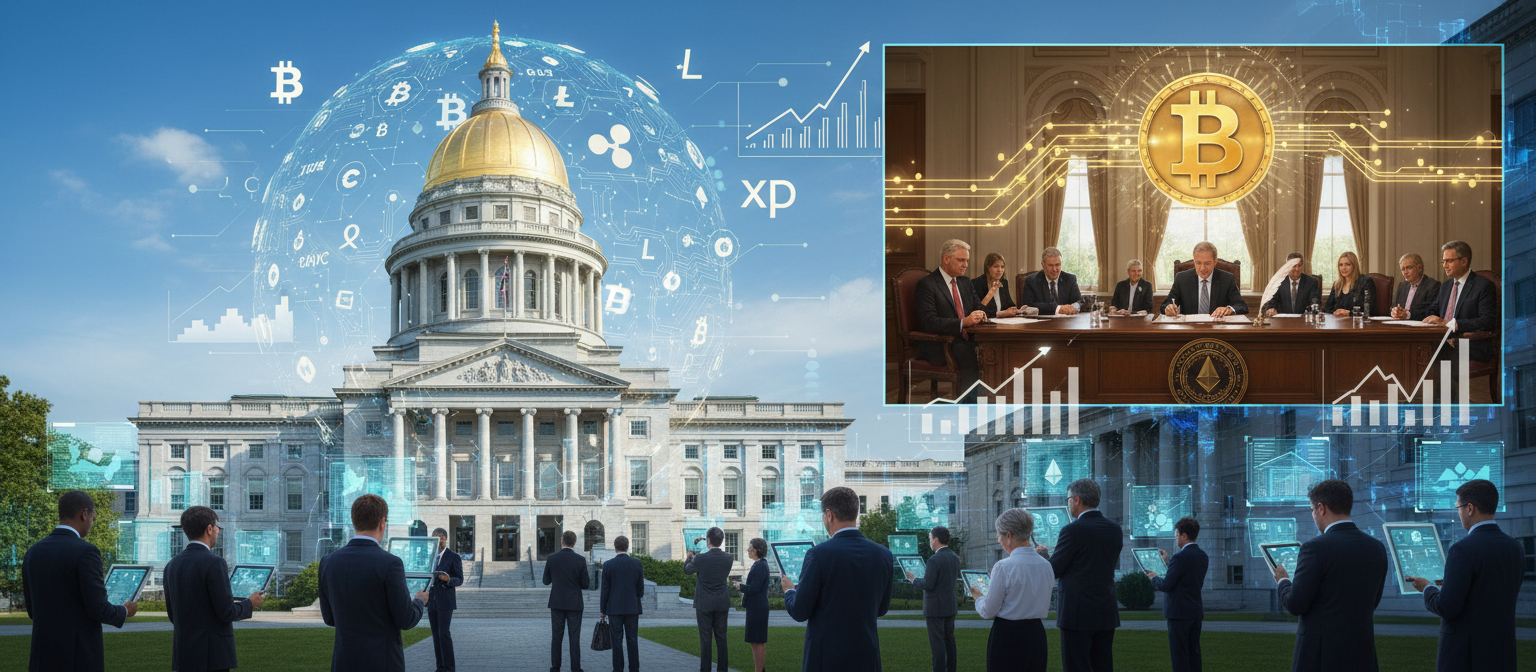

Texas Governor Abbott signs SB 21 creating state Bitcoin reserve, joining growing movement of states embracing cryptocurrency as strategic asset

Major legislative changes to DeFi regulation create new framework for digital asset classification, potentially unleashing institutional capital into decentralized finance protocols

Fed Chair Jerome Powell announces banks can offer cryptocurrency services with proper risk controls, marking watershed moment for crypto mainstream adoption

Bitcoin breaks $112,000 to new all-time high driven by institutional ETF inflows and network hashrate approaching 1 zettahash amid post-halving dynamics

JPMorgan, Bank of America, Citigroup, Wells Fargo and other major banks reportedly discuss creating a joint stablecoin, marking a significant shift in traditional banking institutions approach to cryptocurrency

Bitcoin reaches new all-time high above $122,000 driven by unprecedented institutional ETF inflows and favorable macroeconomic conditions

New Hampshire passes groundbreaking legislation legalizing cryptocurrency and precious metals investments, marking first state-level comprehensive digital asset framework

Britain publishes draft legislation bringing crypto exchanges and custodians under unified regulatory oversight while MicroStrategy expands holdings to 553,555 BTC

Himalayan kingdom leverages abundant hydropower resources for sustainable cryptocurrency mining, creating new economic model that balances environmental values with financial innovation.

Private sector stablecoins outpace government CBDC initiatives as $234B stablecoin market grows and central banks retreat from digital currency projects

President Trump signs H.J. Res. 25, overturning IRS regulations that would have imposed broker reporting requirements on DeFi platforms, marking a significant win for the cryptocurrency industry

Record transaction volumes and institutional holdings signal Ethereum evolution from speculative asset to enterprise blockchain infrastructure

Hut 8 partners with Trump sons to launch American Bitcoin mining subsidiary as cryptocurrency closes worst first quarter since 2018, down 11.7% amid tariff uncertainty

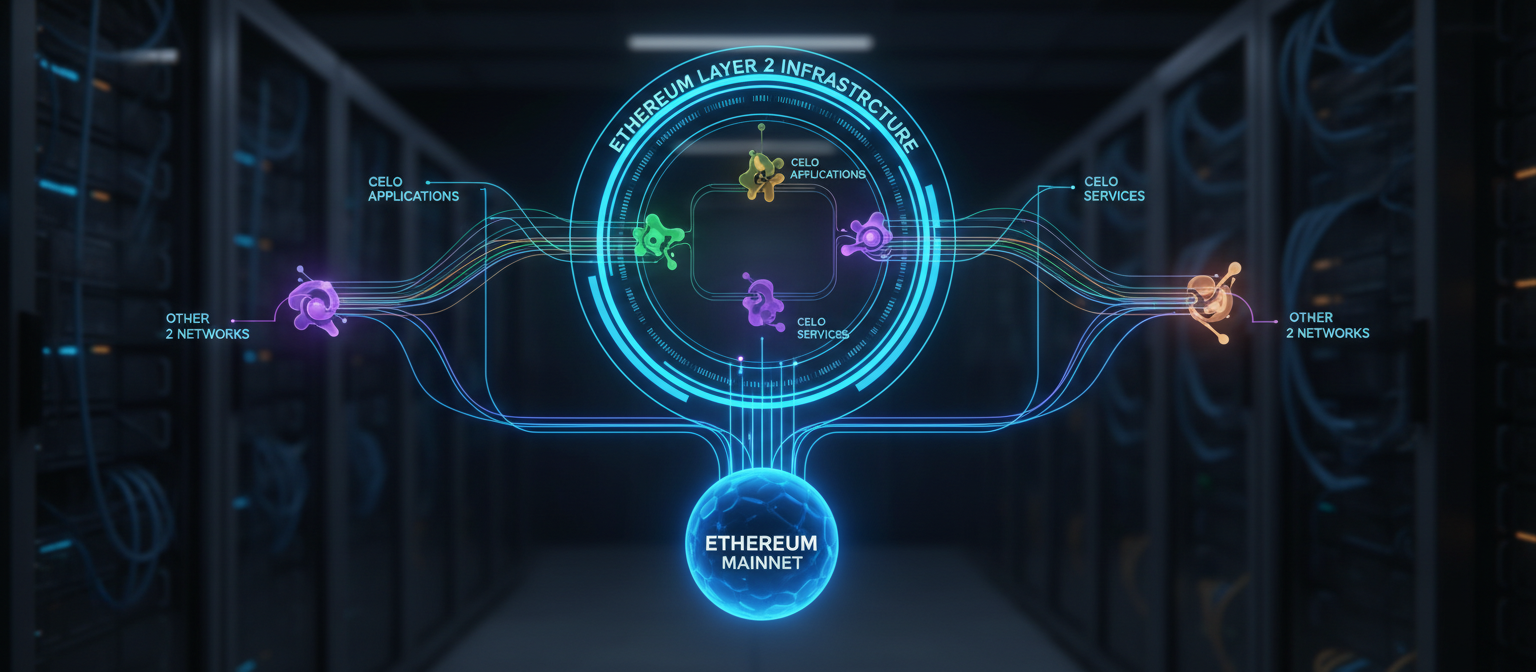

Celo successfully completes its two-year transition to an Ethereum layer 2 network using Optimism OP Stack, marking a significant milestone in blockchain interoperability and scaling.

The largest cryptocurrency heist in history raises serious security questions as the Trump administration pushes to make America the crypto capital of the world

Worlds largest asset manager allocates 1-2% of $150B model portfolio to Bitcoin ETFs, marking watershed moment for cryptocurrency institutional adoption

U.S. banking regulator OCC rescinds restrictive crypto guidance, allowing banks to engage in digital asset activities without prior supervisory approval in major policy reversal.

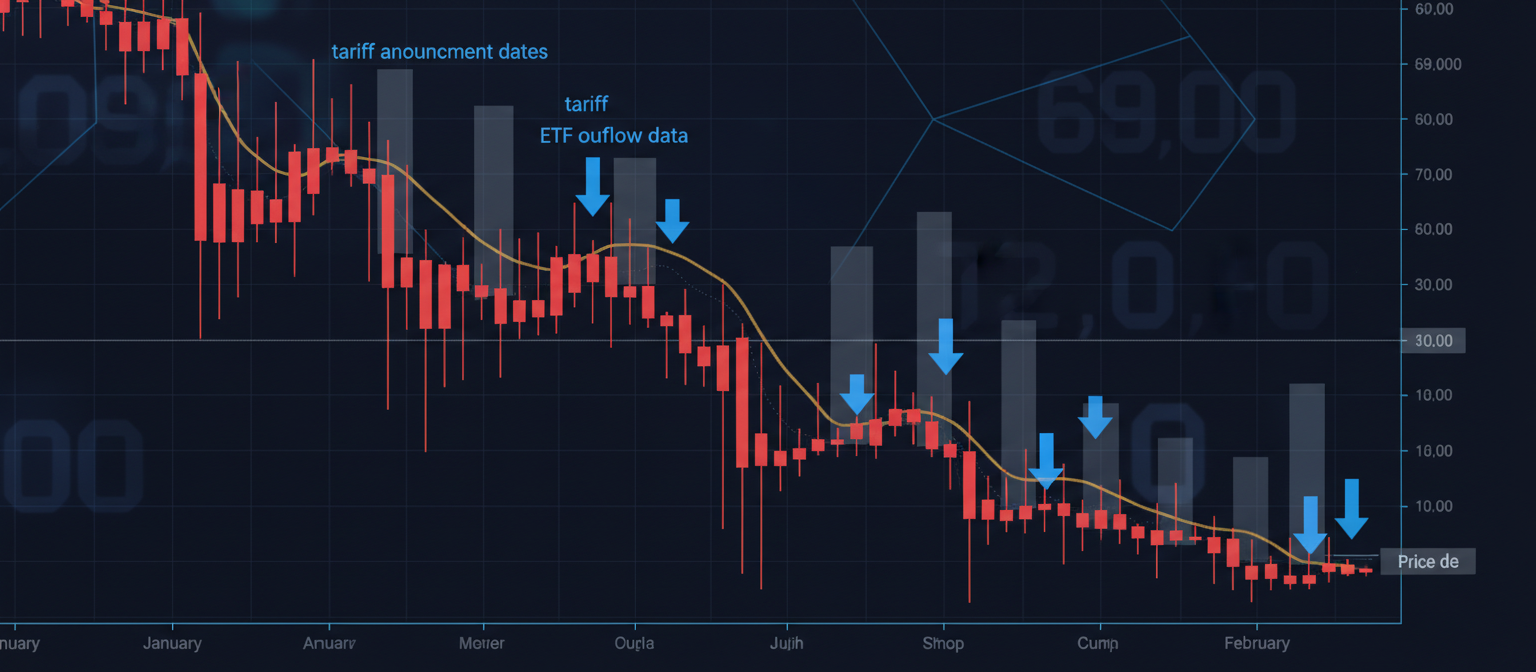

Bitcoin falls to $82,000 range as Trump tariff uncertainty drives $2.6B weekly ETF exodus, with BlackRock IBIT posting record single-day outflows

Lack of clear federal framework prevents institutions from fully embracing stablecoins despite growing interest and market potential

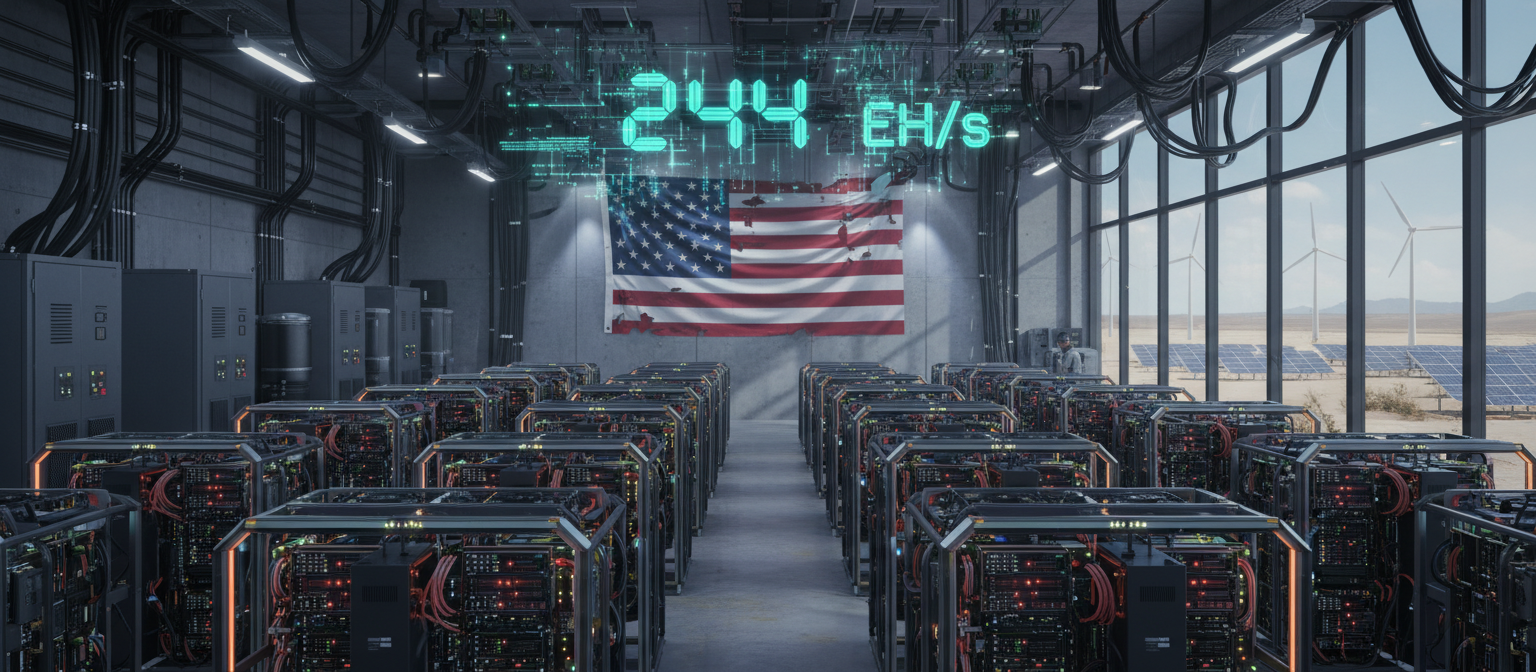

U.S.-listed Bitcoin miners now control 29% of global hashrate, nearly doubling from previous year as institutional mining operations consolidate power

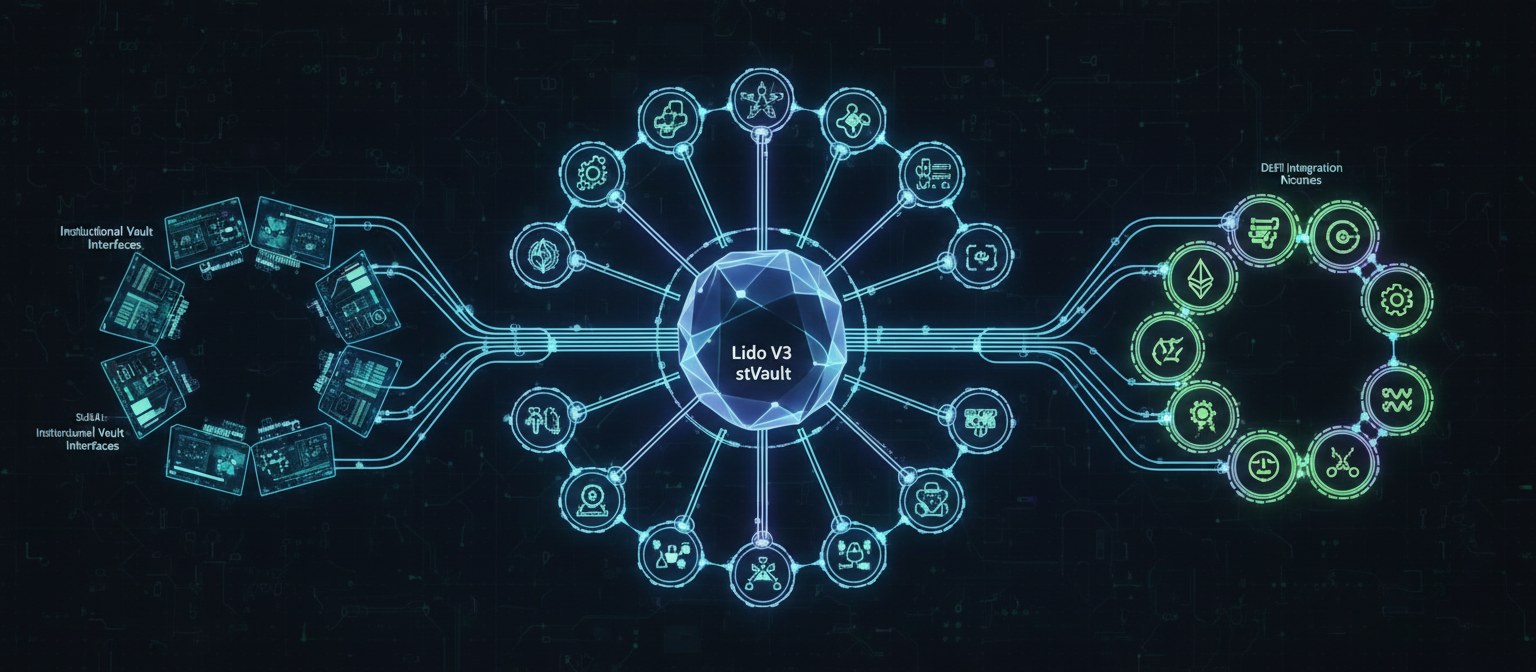

Lido launches V3 upgrade introducing stVaults for customizable institutional Ethereum staking solutions, addressing growing demand from sophisticated investors and compliance requirements.

Polygon's groundbreaking zkEVM technology promises to solve Ethereum's scalability challenges while maintaining security and decentralization

At least 14 U.S. states introduce Strategic Bitcoin Reserve legislation in January, potentially outpacing federal efforts to establish government Bitcoin holdings

U.S. Senate confirms Scott Bessent as Treasury Secretary, bringing pro-crypto perspective to federal financial leadership as Trump administration continues digital asset policy overhaul.

New referral platform Pyramid.is offers crypto users a straightforward way to earn through community connections, with $5 activation and $3 per referral in multi-coin payouts

BlackRock launches low-cost iShares Bitcoin ETF in Canada, immediately prompting Fidelity to cut fees as competition heats up in the competitive Canadian crypto ETF market

Donald Trump launches $TRUMP memecoin on Solana blockchain just days before inauguration, reaching $75B valuation and sparking market controversy

Chicago Mercantile Exchange sees unprecedented cryptocurrency futures volume as institutional investors embrace regulated digital asset derivatives markets

Bitcoin ends transformational 2024 with 147% gains, historic $100K breakthrough, and mainstream acceptance through spot ETF approval

European Union MiCA regulations force major stablecoin market restructuring as exchanges delist non-compliant tokens and Circle gains regulatory advantage

Coinbase removes Tether USDT and five other stablecoins from European exchanges as EU MiCA regulations force major compliance shift in crypto markets

Bitcoin surges 37% in November following Trump election victory, closing month at $96,449 as six-figure price target comes into focus

Nasdaq launches options trading on BlackRock IBIT as SEC approval clears final hurdles, opening new hedging and leveraged strategies for institutional Bitcoin exposure

BlackRock IBIT achieves historic $1.12 billion single-day inflow as Bitcoin ETFs attract $1.38 billion following Trump election victory and Fed rate cuts

Putin signs landmark law legalizing cryptocurrency mining effective November 1, creating regulated framework for industry while positioning Bitcoin as sanctions evasion tool

Record institutional demand drives Bitcoin to $120K and Ethereum above $4,300 as ETF inflows surge to unprecedented levels during October market rally

Ethereum co-founder outlines ambitious roadmap to achieve 100K transactions per second while maintaining decentralization through rollup-centric approach

U.S. spot Bitcoin ETFs record second-best week of inflows since launch with $3.2B surge, signaling renewed institutional confidence