Bitcoin shattered its previous all-time high this week, surging past 112,000 dollars on May 22 and establishing a new record that reflects the cryptocurrency’s continued institutional adoption and network strength. The rally—which pushed Bitcoin more than 15 percent above its January inauguration-day peak of 109,000 dollars—comes amid record ETF inflows, surging mining hashrate, and growing corporate treasury adoption that analysts say could propel the cryptocurrency to 180,000 dollars by year-end.

The new all-time high marks a decisive breakout from the consolidation zone that characterized April and early May, with Bitcoin spending weeks digesting the recovery from Q1’s tariff-driven correction. At current levels around 111,500 dollars, Bitcoin has gained approximately 36 percent from the March lows near 82,000 dollars, validating the thesis that the cryptocurrency’s post-halving supply dynamics and institutional demand would eventually overcome macroeconomic headwinds.

The milestone arrives as Bitcoin’s mining network demonstrates unprecedented strength, with hashrate climbing toward 1 zettahash and difficulty set to reach a record 126.95 trillion in the upcoming adjustment around May 30. The combination of price strength and network security metrics suggests Bitcoin is entering a new phase of maturation—one where institutional participation and infrastructure robustness reinforce each other in a virtuous cycle.

The Rally: From Consolidation to New Highs

Bitcoin’s path to 112,000 dollars reflects a market that has fundamentally changed since the cryptocurrency’s early days. Unlike previous all-time highs driven primarily by retail speculation, this rally is powered by institutional capital flows through spot Bitcoin ETFs that have normalized cryptocurrency exposure for traditional finance.

The breakout began in early May as Bitcoin consolidated above 105,000 dollars, establishing a base that gave bulls confidence to push toward new highs. The decisive move came May 22, when Bitcoin surged through 110,000 dollars and continued to 112,000 dollars in a matter of hours—a rapid ascent that caught some traders off guard but reflected the strong bid underlying the market.

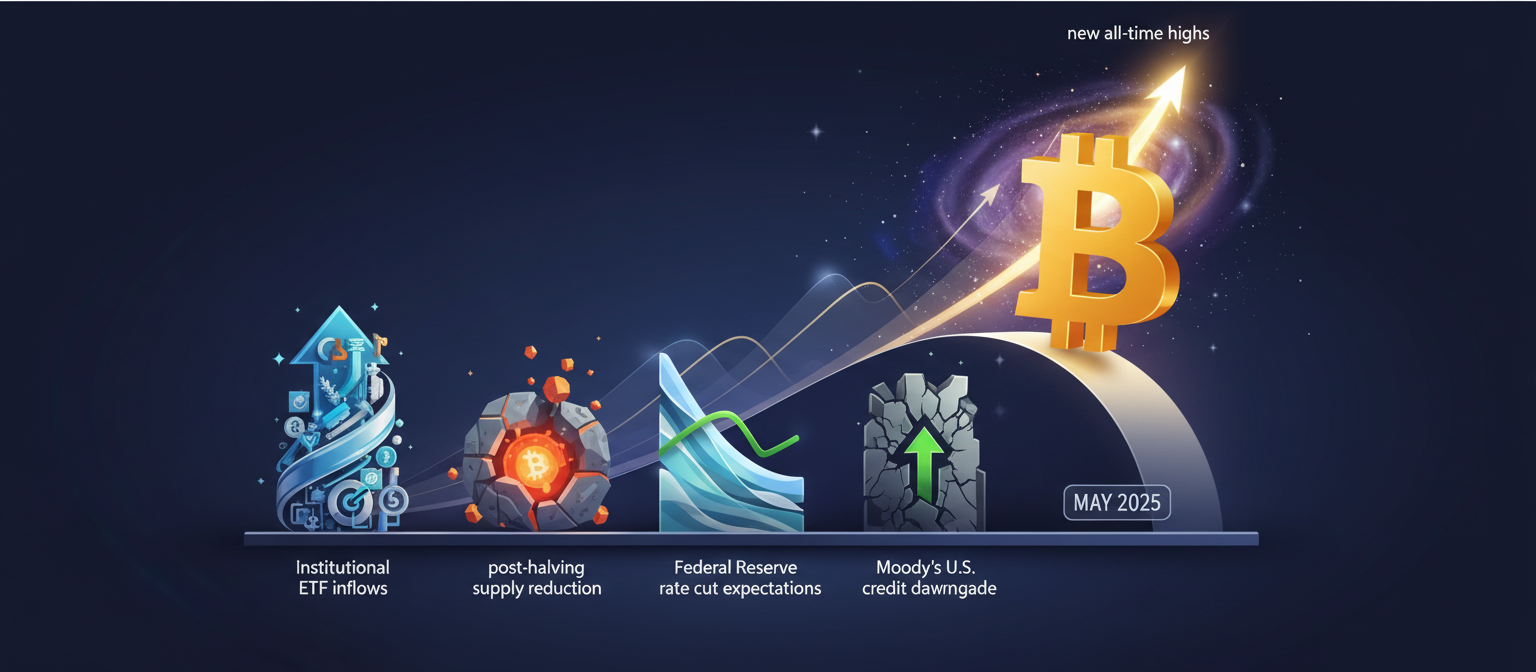

Several catalysts converged to fuel the rally:

Spot ETF Inflows: Institutional buying through Bitcoin ETFs accelerated in May, with major fund managers allocating capital to cryptocurrency exposure. The ETF structure removes custody and regulatory barriers that previously prevented institutional participation, creating a steady flow of buy-side demand that absorbs available supply.

Post-Halving Supply Dynamics: The April 2024 halving reduced Bitcoin’s block reward from 6.25 to 3.125 BTC, cutting new supply issuance by 50 percent. With approximately 450 fewer Bitcoin entering circulation daily, the supply-demand imbalance has intensified—particularly as institutional demand remains strong.

Fed Policy Expectations: Recent Federal Reserve minutes indicated support for at least one rate decrease in 2025, fueling risk-on sentiment across financial markets. Lower rates reduce the opportunity cost of holding non-yielding assets like Bitcoin, making cryptocurrency more attractive relative to bonds and cash.

Moody’s Downgrade: The credit rating agency’s recent downgrade of U.S. sovereign debt sparked renewed interest in Bitcoin as a hedge against fiscal uncertainty and potential currency debasement. The “debasement trade” narrative—positioning Bitcoin as protection against monetary expansion and debt accumulation—gained traction among institutional investors seeking alternatives to traditional safe havens.

The rally’s character differs notably from previous bull runs. Volume profiles show consistent institutional participation rather than the explosive retail-driven spikes that characterized 2017 and 2021 peaks. Order book depth has increased significantly, with large buy walls appearing at key support levels—evidence that sophisticated players are building positions with long time horizons.

Transaction fee dynamics also tell a revealing story. Despite Bitcoin reaching new all-time highs, on-chain fees remain subdued at approximately 2 satoshis per virtual byte (about 30 cents), indicating that speculative activity remains relatively muted. The rally is occurring with relatively low on-chain congestion, suggesting it’s driven more by spot ETF flows and OTC transactions than by retail frenzy on cryptocurrency exchanges.

The $115K Resistance: Understanding Market Mechanics

While Bitcoin has broken through 112,000 dollars, analysts are now focusing on 115,000 dollars as a critical resistance level where market structure could slow the rally’s momentum. The resistance doesn’t stem from technical analysis or psychological round numbers, but from derivatives market dynamics that create what traders call an “invisible hand”—forces that limit price volatility through hedging mechanics.

The mechanism centers on options market positioning. Dealers who sell call options to bullish traders must hedge their exposure by buying Bitcoin as the price rises toward strike prices. However, when dealers have sold substantial call options at higher strikes—particularly around 115,000 to 150,000 dollars—they accumulate “positive gamma” exposure that requires them to sell Bitcoin as prices increase, creating a natural brake on rallies.

Ryan Lee, chief analyst at Bitget Research, explains that this dealer hedging activity acts as a contrarian force: “When Bitcoin approaches levels where dealers have significant positive gamma, their delta-hedging requirements mean they must sell into strength. This creates resistance that can slow or temporarily halt rallies, even when underlying fundamentals remain bullish.”

The positive gamma positioning around 115,000 dollars reflects the options market’s structure coming into May. Traders bought calls at higher strikes anticipating Bitcoin’s rally, and dealers who sold those calls now hold positions requiring them to hedge by selling spot Bitcoin as it approaches those levels. The result is a zone where market makers’ mechanical hedging needs can dampen volatility and create resistance regardless of bullish sentiment.

Despite this potential headwind, analysts remain constructive on Bitcoin’s medium-term trajectory. The invisible hand may slow the rally, but it doesn’t fundamentally change the supply-demand dynamics driving prices higher. As Alexander S. Blume, macro researcher at Blockware Solutions, notes: “OTC supply continues drying up as corporate treasuries and sovereign entities compete for Bitcoin. The 115K resistance is real, but it’s tactical rather than strategic—a speed bump, not a roadblock.”

Mining Network Strength: Approaching 1 Zettahash

While price captures headlines, Bitcoin’s mining network is quietly achieving milestones that underscore the cryptocurrency’s infrastructure maturation. Bitcoin’s hashrate—the total computational power securing the network—has surged to approximately 918 exahashes per second (EH/s) on a seven-day average, up from 840 EH/s just two weeks ago. The rapid increase puts Bitcoin within striking distance of 1 zettahash (1,000 EH/s), a psychological milestone that would represent a tenfold increase from levels just three years ago.

The hashrate surge reflects two dynamics: existing miners bringing additional capacity online as Bitcoin’s price improves profitability, and new mining operations launching as public companies expand infrastructure. HIVE Digital recently announced its hashrate exceeded 10 EH/s, while Marathon Digital (MARA) reported nearly 55 EH/s of realized hashrate in May—a 23 percent monthly increase that demonstrates aggressive capacity expansion.

With hashrate climbing, Bitcoin’s network difficulty—the parameter that adjusts mining complexity to maintain 10-minute average block times—is set to increase approximately 4 percent to a record 126.95 trillion around May 30. The adjustment will mark a new all-time high, surpassing the previous record of 123 trillion and reflecting the intensifying competition among miners to secure block rewards.

The difficulty increase arrives at a challenging moment for mining economics. Despite Bitcoin’s price rally, miner profitability remains constrained by post-halving dynamics. Hashprice—the expected daily revenue per terahash of mining power—briefly spiked to 58 dollars per petahash when Bitcoin hit 112,000 dollars on May 23, but has since settled around 52 dollars. These levels, while improved from April’s lows, represent substantial compression from pre-halving profitability.

The paradox of rising hashrate amid moderate profitability reflects miners’ long-term conviction. Deploying mining infrastructure requires capital commitments measured in years, not months. Miners are betting that Bitcoin’s price will continue appreciating and that operational efficiency gains will offset reduced block rewards and increasing difficulty. The hashrate growth suggests miners collectively believe current market conditions represent an attractive entry point for infrastructure investment.

Transaction fees provide minimal relief for mining economics, currently contributing just 1.3 percent of block rewards. With fees at 2 sat/vB and blocks not consistently full, miners are almost entirely reliant on block subsidies—currently 3.125 BTC per block—for revenue. This makes hashprice extremely sensitive to Bitcoin’s dollar price, creating tight coupling between market conditions and mining profitability.

Institutional Adoption: The Corporate Treasury Movement

Beyond ETF flows, a quieter but potentially more significant development is accelerating: corporate Bitcoin treasury adoption. Companies are increasingly adding Bitcoin to balance sheets, viewing the cryptocurrency as a strategic asset that offers inflation protection and potential appreciation while diversifying away from pure fiat holdings.

The trend extends beyond MicroStrategy, the pioneering corporate Bitcoin adopter. Public mining companies like Marathon Digital and HIVE are retaining more of their mined Bitcoin rather than immediately selling to cover operational expenses—a shift that reflects confidence in appreciation potential and willingness to manage balance sheet volatility.

The corporate treasury movement creates a distinct category of Bitcoin demand with different characteristics from retail or even traditional institutional buyers:

Long Time Horizons: Corporate treasuries typically manage cash with multi-year perspectives, seeking assets that preserve purchasing power over business cycles. This creates sticky demand less susceptible to short-term volatility.

Competitive Dynamics: As more corporations adopt Bitcoin treasuries, competitive pressure builds on peers to consider similar strategies. Finance officers must justify to boards why their companies hold depreciating cash while competitors hold appreciating Bitcoin.

OTC Supply Absorption: Corporate buyers typically transact over-the-counter rather than on exchanges, absorbing available supply in private markets. This reduces floating supply available to retail traders, creating price pressure that isn’t immediately visible in exchange order books.

Alexander S. Blume’s observation about “drying OTC supply” reflects this dynamic. As corporate treasuries and sovereign entities—several nations are exploring strategic Bitcoin reserves—compete for available Bitcoin, sellers have less incentive to offer supply below prevailing prices. The result is a bid that gradually lifts the entire market, with spot prices rising to clear scarce supply.

The sovereign dimension adds geopolitical implications. While no major nation has formally announced Bitcoin reserve holdings, multiple countries are exploring the concept as hedge against dollar dominance and fiscal uncertainty. If even one G20 nation establishes a strategic Bitcoin reserve, the precedent could trigger competitive accumulation among nations seeking similar diversification—a scenario some analysts call “the sovereign FOMO trade.”

Technical Perspective: Consolidation or Continuation?

From a technical analysis standpoint, Bitcoin’s breakout above 112,000 dollars resolves months of consolidation in favor of bulls. The cryptocurrency spent April and early May forming a base above 100,000 dollars, with multiple tests of support around 105,000 establishing a floor that gave traders confidence to buy dips.

The breakout came on strong volume, a bullish signal suggesting institutional participation rather than a thin rally susceptible to reversal. Volume-weighted average price (VWAP) metrics show buyers willing to pay up for Bitcoin at current levels, supporting the view that this isn’t simply a momentum-driven spike but a genuine shift in market structure.

Key resistance levels ahead include:

$115,000: The options market barrier where dealer gamma hedging could slow momentum. A decisive break above this level would likely trigger additional buying as short-term resistance gives way.

$120,000: A psychological round number and potential target for profit-taking. Reaching 120,000 would represent a 10 percent gain from current levels and might prompt some holders to lock in profits.

$125,000: The level where some analysts see significant overhead supply from holders who bought near previous peaks and are waiting to exit breakeven or slight profit.

Support levels have shifted higher with the rally:

$108,000: The breakout level from consolidation, now initial support. Holding above this level would confirm the new all-time high as a base for further appreciation rather than a failed breakout.

$105,000: The consolidation floor that established the pre-breakout base. A return to these levels would suggest the rally exhausted and potentially signal a deeper correction.

$100,000: Psychological support and the level below which technical bulls might reconsider bullish positioning. Breaking below six figures would likely trigger stop-loss selling and potentially unwind leveraged long positions.

On-chain metrics support the bullish technical picture. Whale accumulation—large holders adding to positions—has accelerated during the rally, with addresses holding more than 1,000 BTC increasing holdings. Exchange balances continue declining, indicating holders are moving Bitcoin to cold storage rather than preparing to sell on exchanges—a signal of conviction in higher prices ahead.

Risks and Headwinds

Despite the bullish setup, several factors could derail Bitcoin’s rally or trigger correction:

Macroeconomic Reversal: Bitcoin’s correlation with risk assets means adverse macro developments—geopolitical shocks, unexpected inflation, Fed policy reversal—could trigger broad risk-off sentiment that pulls cryptocurrency lower alongside equities.

Regulatory Uncertainty: While U.S. regulatory clarity has improved with ETF approval, global regulatory developments remain unpredictable. Adverse regulation in major markets could undermine institutional confidence and slow adoption.

Derivatives Market Deleveraging: Bitcoin’s derivatives markets carry substantial open interest in leveraged positions. A sharp move in either direction could trigger cascading liquidations that amplify volatility and potentially reverse the rally.

Mining Centralization Concerns: As difficulty increases and profitability compresses, smaller miners may be forced offline, concentrating hashrate among large public companies. While this doesn’t directly threaten Bitcoin’s security, it raises concerns about mining industry consolidation and geographic distribution.

Profit-Taking Pressure: Bitcoin has rallied substantially from March lows, and some holders may view current levels as attractive exit points. Coordinated profit-taking could overwhelm bid-side demand and trigger correction.

The positive gamma positioning around 115,000 dollars represents a near-term tactical risk rather than strategic concern. However, if Bitcoin approaches this level and stalls, trader psychology could shift from FOMO to caution, reducing buying pressure and potentially triggering technical selling.

Looking Ahead: The Path to $180K

Despite near-term risks, analyst projections for Bitcoin remain bullish. Ryan Lee’s year-end target of 180,000 dollars—a 60 percent gain from current levels—reflects confidence that underlying fundamentals will drive continued appreciation:

ETF Inflows: Institutional allocation to Bitcoin remains in early stages, with most traditional portfolios holding minimal or zero cryptocurrency exposure. As Bitcoin demonstrates staying power and regulatory clarity improves, allocation percentages will likely increase, generating sustained buy-side demand.

Supply Scarcity: The post-halving supply squeeze hasn’t fully played out. With 450 fewer Bitcoin minted daily and institutional demand steady or increasing, the supply-demand imbalance will intensify over coming months.

Macro Environment: If the Fed proceeds with rate cuts as markets expect, lower rates will improve Bitcoin’s relative attractiveness. The debasement trade narrative gains credibility as fiscal deficits persist and monetary policy remains accommodative.

Network Effects: As Bitcoin’s network hashrate and user adoption grow, the cryptocurrency becomes more entrenched as digital gold and potential monetary alternative. Network effects create self-reinforcing adoption dynamics that are difficult to reverse.

For the 180,000-dollar target to materialize, Bitcoin would need to maintain its current trajectory through year-end—averaging roughly 3 percent monthly appreciation from June through December. While ambitious, this pace is modest compared to previous bull market rallies and assumes no dramatic acceleration.

Alternative scenarios include extended consolidation at current levels as the market digests the rally, or a more aggressive move toward 150,000 dollars followed by correction and re-accumulation. Much depends on macro conditions, institutional flows, and whether technical resistance around 115,000 dollars proves formidable or easily surmounted.

Implications for the Ecosystem

Bitcoin’s rally to new all-time highs carries implications beyond price:

Altcoin Markets: Bitcoin dominance—its share of total cryptocurrency market capitalization—has increased during the rally, suggesting capital is flowing preferentially to the most established digital asset. This could pressure altcoins in the near term, though historical patterns suggest Bitcoin rallies eventually broaden to include alternative cryptocurrencies.

Mining Industry: Higher Bitcoin prices improve mining economics, potentially slowing the post-halving shakeout that threatened smaller operators. However, rising difficulty ensures competition remains intense, favoring efficient miners with access to cheap electricity.

Regulatory Landscape: Price strength attracts regulatory attention, both positive and negative. Policymakers may feel increased urgency to establish clear frameworks as Bitcoin’s market cap approaches and potentially exceeds major fiat currencies.

Mainstream Adoption: All-time highs generate media coverage that introduces Bitcoin to new audiences. While this can drive retail participation, it also prompts questions about sustainability and whether current prices reflect fundamental value or speculative excess.

DeFi and Layer 2s: Bitcoin’s rally benefits the broader cryptocurrency ecosystem by increasing total capital available for allocation. While Bitcoin itself has limited smart contract functionality, higher prices can drive interest in Bitcoin-based DeFi protocols and Layer 2 scaling solutions like Lightning Network.

Conclusion

Bitcoin’s surge past 112,000 dollars to a new all-time high reflects the cryptocurrency’s evolution from speculative asset to institutional holding. The rally—powered by ETF inflows, post-halving supply dynamics, and growing corporate adoption—demonstrates that Bitcoin has achieved a level of market maturation where traditional finance institutions treat it as a legitimate portfolio component.

The network’s strength reinforces this narrative. With hashrate approaching 1 zettahash and difficulty reaching record levels, Bitcoin’s infrastructure has never been more robust. Miners are investing billions in capacity despite compressed profitability, signaling conviction that Bitcoin’s long-term value proposition justifies near-term economic challenges.

Near-term, the 115,000-dollar resistance level poses a tactical challenge where options market mechanics could slow momentum. But the strategic picture remains bullish: institutional demand is accelerating, supply is scarce and getting scarcer, and macroeconomic conditions increasingly favor alternative monetary assets over depreciating fiat.

Whether Bitcoin reaches analyst targets of 180,000 dollars by year-end depends on variables largely outside the cryptocurrency’s control—Fed policy, geopolitical developments, regulatory decisions. But the fundamentals supporting higher prices are more firmly established than at any previous point in Bitcoin’s history.

As May draws toward a close with Bitcoin consolidating above 111,000 dollars, the cryptocurrency faces a critical juncture. Breaking decisively through 115,000 dollars would open a path toward 120,000 and beyond, potentially accelerating the rally as FOMO overcomes technical resistance. Alternatively, a period of consolidation at current levels would allow the market to digest gains and build a base for the next leg higher.

Either scenario keeps Bitcoin on track for a landmark year—one where institutional adoption, network strength, and price appreciation converge to validate the thesis that digital scarcity represents the future of monetary systems in an era of unbounded fiat creation.

This article reflects market conditions and developments as of May 25, 2025.