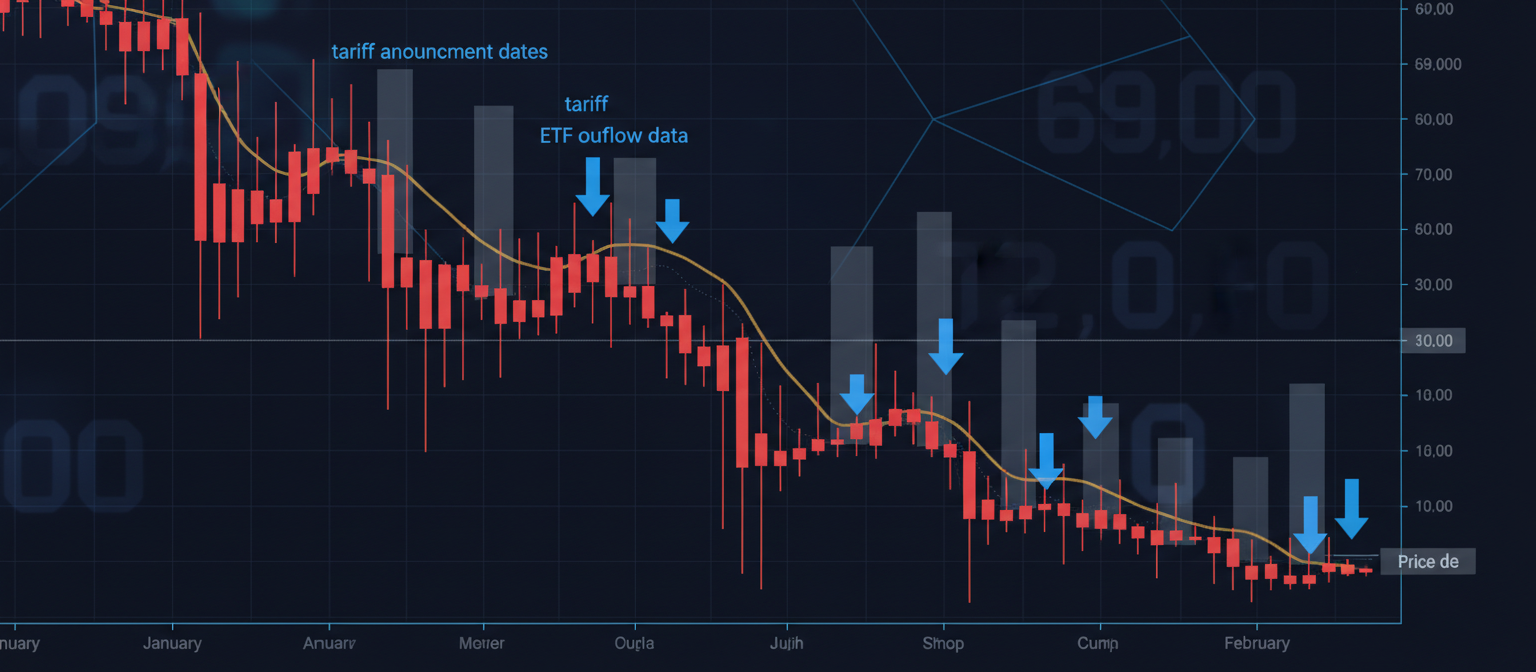

Bitcoin is trading around 82,000 dollars this morning, marking a 25 percent decline from the all-time high of 109,000 dollars set just eight weeks ago in January. The sharp correction represents the cryptocurrency’s most significant pullback since its historic breach of six figures, driven by a toxic combination of Trump administration tariff announcements, massive institutional selling through Bitcoin ETFs, and broader risk-off sentiment across financial markets.

The sell-off intensified this week as investors grappled with escalating trade policy uncertainty and its potential impact on economic growth. Spot Bitcoin ETFs recorded over 2.6 billion dollars in net outflows over the past week, with BlackRock’s IBIT posting a record 420 million dollar single-day exodus on February 26. The cryptocurrency fear and greed index plunged to 10 on February 27—its lowest reading since July 2022—signaling extreme fear among market participants.

Trump Tariffs Shatter Risk Appetite

The immediate catalyst for Bitcoin’s February decline came from President Trump’s aggressive tariff policies announced in early February. On February 1, Trump unveiled 25 percent tariffs on imports from Canada and Mexico, along with 10 percent tariffs on Chinese goods, initially scheduled to take effect February 4.

Bitcoin plummeted 8 percent to 93,000 dollars following the announcement, marking its sharpest single-day decline in three months. The cryptocurrency briefly recovered when Trump agreed to a 30-day pause on the Canada and Mexico tariffs on February 3, allowing Bitcoin to trade back above 100,000 dollars. However, that proved to be the last time Bitcoin would hold six-figure pricing.

The Chinese tariffs took effect as scheduled on February 4, and Bitcoin began a steady descent that accelerated through the month. By February 26, the cryptocurrency had fallen to 82,455 dollars—breaking below the psychologically important 85,000 dollar support level that had held through much of the post-election rally.

The tariff impact extends beyond direct trade policy concerns. Investors fear that 25 percent tariffs on imports from America’s two largest trading partners will drive inflation higher while simultaneously slowing economic growth—a stagflationary scenario particularly hostile to risk assets like Bitcoin. Traditional markets have suffered alongside cryptocurrency, with the S&P 500 and Nasdaq posting significant declines since the tariff announcements.

Bitcoin’s correlation with equity markets has reasserted itself during the February downturn, undermining the narrative that cryptocurrency serves as an uncorrelated alternative asset. When macro uncertainty rises and risk appetite collapses, Bitcoin has traded as a risk-on asset rather than a safe haven—falling alongside stocks rather than holding value like gold.

Record ETF Outflows Signal Institutional Retreat

The institutional selling pressure driving Bitcoin lower is starkly visible in spot Bitcoin ETF flows. The week of February 24-28 saw net outflows of 2.61 billion dollars across all spot Bitcoin ETFs—representing sustained institutional liquidation at a scale not witnessed since the products launched in January 2024.

BlackRock’s IBIT, the largest and most successful Bitcoin ETF with over 40 billion dollars in assets, recorded its worst single-day outflow on February 26 when 418 million dollars exited the fund. The outflow represented approximately 5,000 Bitcoin leaving IBIT in a single trading session, demonstrating that even the most established institutional Bitcoin vehicles are experiencing significant redemption pressure.

The selling hasn’t been limited to BlackRock. Across the ETF complex, eight consecutive days of net outflows preceded February 28, with only a modest 94 million dollar inflow on the final day of the month failing to reverse the overwhelmingly negative trend. When aggregated across all providers, Bitcoin ETFs have seen their longest sustained outflow streak since launch.

The ETF outflow dynamic creates direct selling pressure on Bitcoin’s spot price. When ETF shares are redeemed, authorized participants must sell the underlying Bitcoin to meet redemption requests, pushing supply into a market already weakened by tariff-driven risk aversion. The scale of institutional selling through ETFs represents a fundamental shift from the accumulation pattern that characterized most of 2024 and early 2025.

What makes the current selling particularly noteworthy is its persistence despite Bitcoin trading 25 percent below its all-time high. During previous corrections, institutional buyers typically emerged at 15-20 percent drawdowns to accumulate at perceived discounts. The absence of that institutional bid this time suggests either that macro concerns have genuinely shifted allocation decisions, or that institutions are waiting for clearer resolution of tariff policy before committing additional capital.

The ETF outflows also represent a test of the thesis that institutional adoption would reduce Bitcoin’s volatility. The products were designed to provide easy, regulated access for traditional investors—theoretically bringing more stable, long-term capital into Bitcoin markets. The February experience suggests that institutional capital can exit just as quickly as it enters when macro conditions deteriorate, potentially amplifying rather than dampening volatility during stress periods.

Fear Index Hits Multi-Year Lows

Market sentiment indicators are reflecting the extent of investor distress. The cryptocurrency fear and greed index—a composite measure of volatility, market momentum, social media sentiment, surveys, dominance, and trends—plunged to 10 on February 27. Readings below 20 indicate extreme fear, and the current level represents the most pessimistic sentiment since July 2022, during the depths of the previous bear market.

The extreme fear reading comes despite Bitcoin’s current price remaining nearly double its July 2022 levels. The sentiment deterioration reflects not just price action but also growing uncertainty about the macroeconomic environment and policy landscape that had previously supported Bitcoin’s rally.

Historically, extreme fear readings have marked attractive entry points for contrarian investors. The July 2022 fear index bottom at similar levels preceded a multi-month consolidation and eventual rally. However, sentiment indicators are descriptive rather than predictive—they tell us how investors feel now, not whether those feelings are justified or when they might change.

The current fear environment has practical implications for near-term price action. Extreme fear often leads to capitulation selling as the last holders give up, creating sharp down moves that exhaust selling pressure. Alternatively, when sentiment is this negative, any positive catalyst can trigger violent short-covering rallies as pessimists are caught wrong-footed.

Market Structure Under Stress

Beyond headline price declines and ETF flows, Bitcoin’s market structure is showing signs of stress that could influence how the correction unfolds. Leverage in cryptocurrency derivatives markets has declined substantially as long positions have been liquidated, reducing the risk of cascading margin calls that characterized past crash events.

Open interest in Bitcoin futures has contracted by approximately 15 percent from January highs, suggesting that speculative leverage has been purged from the system. While painful for leveraged longs, this deleveraging creates healthier conditions for eventual recovery by removing the overhang of positions that must be closed regardless of fundamentals.

The correlation between Bitcoin and traditional risk assets has increased during the February selloff, with Bitcoin trading closely alongside the Nasdaq and S&P 500. When tariff news drives equity markets lower, Bitcoin has consistently followed—reinforcing the narrative that cryptocurrency remains primarily a risk-on asset sensitive to macro conditions rather than an independent store of value.

Exchange balances have shown mixed signals. Some analytics indicate Bitcoin flowing onto exchanges, typically interpreted as preparation for selling. However, long-term holder metrics remain relatively stable, suggesting that the selling pressure is coming primarily from newer, more price-sensitive buyers rather than multi-year holders capitulating.

The Bull Case Under Examination

Bitcoin’s February correction is forcing a reassessment of the bull market thesis that drove the cryptocurrency from 42,000 dollars at the start of 2024 to 109,000 dollars in January 2025. Several pillars of that thesis are now being tested.

The institutional adoption narrative—arguably the strongest bull case driver—remains intact in terms of infrastructure but is being questioned in terms of actual capital commitment. Bitcoin ETFs exist and have accumulated substantial assets, but the February outflows demonstrate that institutional capital isn’t permanently committed. If macro conditions remain unfavorable, more institutional selling could follow.

The scarcity narrative and halving impact haven’t changed—Bitcoin’s supply schedule is immutable regardless of macro conditions. However, scarcity only drives prices higher when demand meets or exceeds supply. The current environment shows that macro headwinds can overwhelm supply dynamics in the near term, even if long-term scarcity remains a fundamental support.

The political and regulatory support that emerged with Trump’s election victory is being complicated by his tariff policies. While the administration remains rhetorically supportive of cryptocurrency and has moved forward with plans for a Strategic Bitcoin Reserve at the federal level, the economic disruption from aggressive tariff implementation is creating cross-currents that weaken risk appetite broadly.

From a technical perspective, Bitcoin has broken several support levels that bulls had identified as likely to hold. The 100,000 dollar psychological level failed to provide meaningful support. The 90,000 dollar level—roughly the price at which MicroStrategy made its massive November purchase—also gave way. The cryptocurrency is now testing the 80,000-85,000 range, which represents the post-election rally’s 50 percent retracement level.

Looking Ahead: Support Levels and Recovery Scenarios

As February closes, Bitcoin investors are focused on where the correction might find a floor and what catalysts could drive recovery. Several potential support levels and scenarios merit attention based on current market structure.

The 80,000 dollar level represents a psychological support zone and roughly aligns with the post-election rally’s 50 percent retracement. If this level holds, it would suggest the bull market structure remains intact despite the sharp correction. A sustained break below 80,000 would open the door to testing the 75,000 level reached immediately after the November election.

Resolution of tariff uncertainty represents the clearest potential positive catalyst. If Trump administration and trading partners reach accommodation that reduces the economic growth concerns, risk appetite could return quickly. Bitcoin’s sharp selloff means the cryptocurrency is positioned to rally violently if macro conditions improve—though the reverse is equally true if tariff conflicts escalate.

ETF flows bear close watching in coming weeks. If institutional selling exhausts and flows turn positive, it would signal that the worst of the correction may be over. Conversely, continued heavy outflows would suggest more downside ahead as the ETF complex works through redemption pressure.

The federal Strategic Bitcoin Reserve initiative could provide support if concrete implementation details emerge. While state-level Bitcoin reserve efforts continue to advance, federal action would represent a larger-scale commitment that could stabilize or reverse the current negative momentum.

From a timing perspective, March historically has been a volatile month for Bitcoin. The combination of quarter-end rebalancing, tax selling considerations, and seasonal patterns could create additional volatility before clearer trends emerge in the second quarter.

The current correction—while painful for those who bought near the all-time high—represents a 25 percent drawdown in a volatile asset that has historically experienced multiple 30-40 percent corrections even within larger bull markets. Whether the February decline represents a healthy consolidation before further gains or the beginning of a deeper bear market will depend largely on factors currently beyond Bitcoin’s control: trade policy, macroeconomic conditions, and the evolution of institutional risk appetite in an uncertain geopolitical environment.

This article reflects market conditions as of February 28, 2025.