BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed $100 billion in assets under management, marking a watershed moment for cryptocurrency institutional adoption and demonstrating the profound transformation of digital assets from speculative investments to mainstream financial instruments. The milestone, reached in mid-July 2025, represents the fastest-growing ETF launch in history and signals that institutional investors have fully embraced Bitcoin as a legitimate component of diversified portfolios.

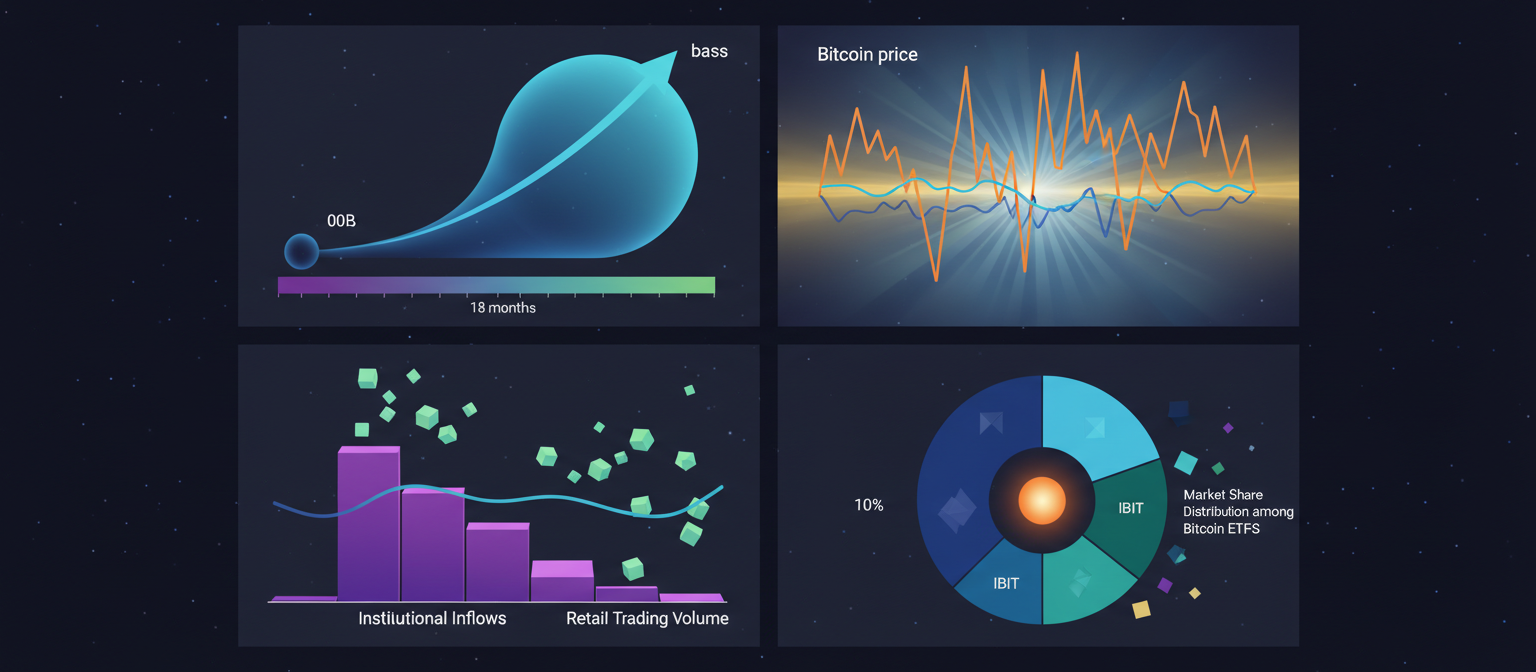

The achievement is particularly remarkable given that IBIT launched just 18 months ago in January 2024. The fund’s rapid ascent to $100 billion AUM surpasses the growth trajectories of even the most successful traditional ETF launches, including those tracking major stock indices and gold. This explosive growth reflects pent-up institutional demand for Bitcoin exposure that was previously constrained by regulatory uncertainty and limited investment options.

Institutional Demand Drives Record Growth

The surge in IBIT’s assets under management reflects broader institutional acceptance of cryptocurrency as an asset class. Major pension funds, endowments, and insurance companies have established significant positions in the ETF, attracted by Bitcoin’s potential as an inflation hedge and portfolio diversifier. The institutional influx has been particularly pronounced since the Trump administration’s pro-crypto policies took effect, reducing regulatory barriers and creating a more favorable environment for digital asset investment.

BlackRock’s reputation and distribution network have proven crucial in driving institutional adoption. The company’s extensive relationships with institutional investors, combined with its rigorous due diligence and compliance standards, have provided the confidence needed for conservative financial institutions to allocate capital to Bitcoin. The fund’s structure, which uses institutional-grade custody solutions and robust security measures, has addressed many of the concerns that previously prevented institutional participation.

The $100 billion milestone represents more than just a symbolic achievement—it demonstrates the depth and durability of institutional Bitcoin demand. Unlike previous cryptocurrency rallies driven primarily by retail speculation, the current institutional wave is characterized by long-term strategic allocations and sophisticated risk management approaches.

Market Impact and Bitcoin Price Dynamics

IBIT’s rapid growth has had significant implications for Bitcoin’s price dynamics and market structure. The fund’s consistent inflows have helped absorb Bitcoin’s circulating supply, potentially contributing to price appreciation and reduced volatility. As institutional investors typically take longer-term positions compared to retail traders, the increased institutional presence may contribute to greater market stability.

Bitcoin’s price has responded positively to institutional adoption, trading above $115,000 as institutional capital continues flowing into the ecosystem. The sustained institutional demand has helped establish higher price floors and reduced the impact of retail-driven volatility that characterized earlier Bitcoin cycles. Market analysts note that the institutionalization of Bitcoin ownership represents a fundamental shift in the cryptocurrency’s market dynamics.

The milestone has also competitive implications for the broader ETF market. While IBIT has emerged as the dominant Bitcoin ETF, other providers including Fidelity, Ark Invest, and Grayscale have also seen substantial inflows. The collective success of Bitcoin ETFs suggests that institutional demand for cryptocurrency exposure continues to expand, potentially supporting further price appreciation and market development.

Regulatory Environment Supports Growth

The achievement occurs within an increasingly supportive regulatory environment for digital assets. The Trump administration’s executive orders on cryptocurrency, combined with Congressional legislation providing clearer regulatory frameworks, have created the certainty needed for institutional investment. The SEC’s more constructive approach to cryptocurrency regulation under new leadership has removed many of the barriers that previously limited institutional participation.

This regulatory clarity has enabled BlackRock and other ETF providers to expand their cryptocurrency offerings, potentially including products focused on other digital assets like Ethereum and Solana. The success of IBIT may accelerate the approval of additional cryptocurrency ETFs, further expanding institutional access to digital asset markets.

The regulatory environment has also improved through specific legislative initiatives like the Financial Innovation and Technology for the 21st Century Act, which provides clear guidelines for digital asset custody and trading. These developments have given institutional investors the confidence needed to allocate significant capital to cryptocurrency markets.

Portfolio Integration and Strategic Implications

The $100 billion milestone reflects a fundamental shift in how institutional investors approach portfolio construction. Bitcoin is no longer viewed as a speculative alternative but as a legitimate component of diversified investment portfolios. Financial advisors and portfolio managers are increasingly recommending Bitcoin allocations of 1-5% for institutional clients, citing its potential as an inflation hedge and portfolio diversifier.

This portfolio integration has significant implications for traditional financial markets. As more capital flows into Bitcoin through regulated vehicles like IBIT, traditional assets may face competitive pressure for investor attention and capital allocation. The shift represents a reallocation of wealth from traditional financial instruments to digital assets, potentially reshaping global capital markets over the coming decades.

The institutional adoption of Bitcoin through IBIT has also created new investment products and services. Major banks and financial institutions now offer Bitcoin custody services, derivative products, and wealth management solutions specifically designed for digital assets. This ecosystem development further reinforces Bitcoin’s position in mainstream finance.

Future Outlook and Market Evolution

Looking forward, IBIT’s continued growth appears likely as more institutions complete their due diligence processes and establish cryptocurrency allocation frameworks. The $100 billion milestone may represent a psychological threshold that encourages previously hesitant institutions to establish Bitcoin positions, potentially driving additional inflows and market growth.

The success of IBIT has paved the way for broader cryptocurrency adoption by institutional investors. As comfort levels increase with Bitcoin ETFs, institutions may explore exposure to other digital assets through similar regulated investment vehicles. This evolution could lead to a more diversified institutional cryptocurrency market beyond Bitcoin.

The achievement also has implications for Bitcoin’s role in the global financial system. As institutional ownership of Bitcoin through regulated vehicles increases, the cryptocurrency may become increasingly integrated into traditional financial infrastructure, potentially reducing its correlation with risk assets and enhancing its appeal as a portfolio diversifier.

Challenges and Considerations

Despite the remarkable success, institutional Bitcoin adoption through ETFs faces ongoing challenges. Regulatory uncertainty persists in some jurisdictions, and concerns about market manipulation and custody security continue to trouble some institutional investors. The volatility that remains characteristic of cryptocurrency markets, even with increased institutional participation, requires sophisticated risk management approaches.

Environmental concerns around Bitcoin mining also remain a consideration for some institutional investors, particularly those with ESG mandates. However, the increasing use of renewable energy in Bitcoin mining and the development of more efficient mining hardware are addressing these concerns over time.

The concentration of Bitcoin ownership through ETFs also raises questions about decentralization and the long-term distribution of Bitcoin supply. As more Bitcoin accumulates in institutional custodians, the ecosystem must balance the benefits of institutional adoption with the principles of decentralization that underpin Bitcoin’s value proposition.

This article reflects market conditions and institutional adoption trends as of July 15, 2025.