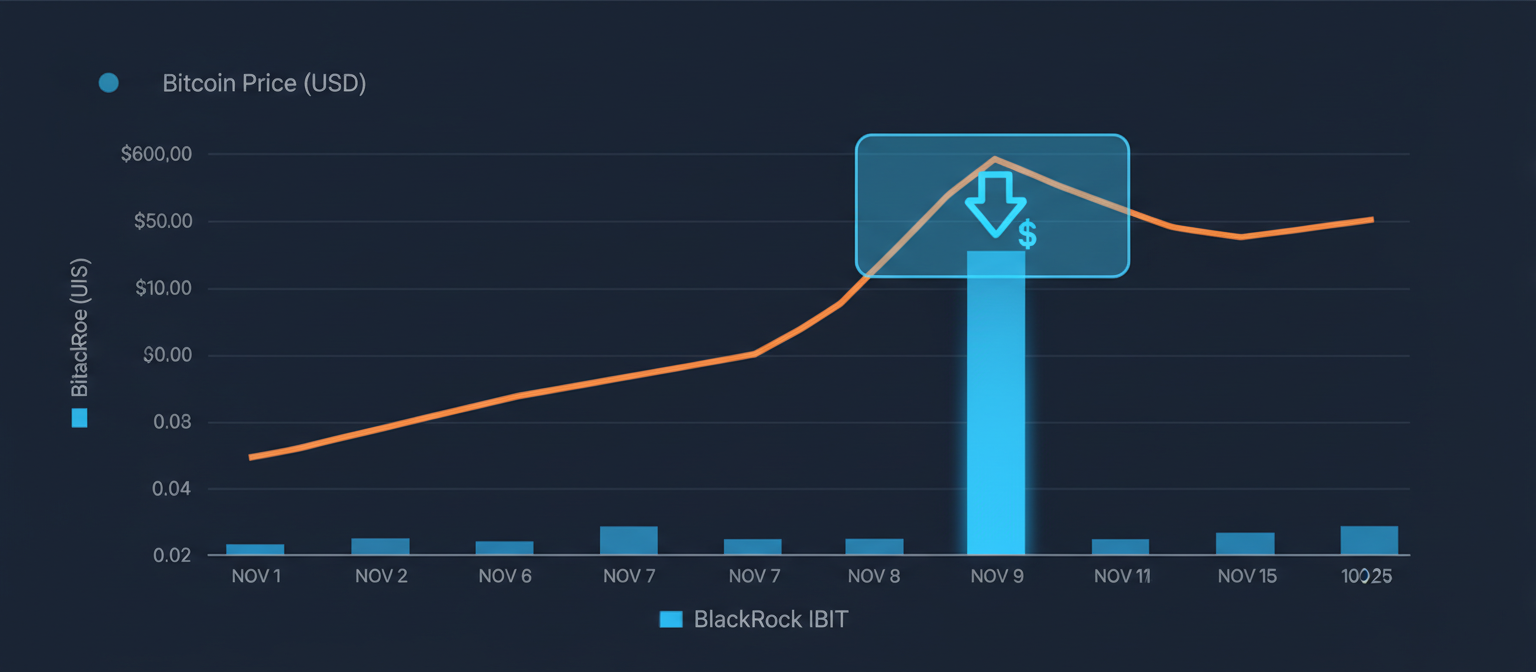

BlackRock’s iShares Bitcoin Trust (IBIT) achieved a stunning single-day record inflow of $1.12 billion on November 7, marking a watershed moment for institutional adoption of cryptocurrency and signaling a fundamental shift in how traditional finance approaches digital assets. The historic flow, which represents 82% of total spot Bitcoin ETF inflows that day, occurred in the immediate aftermath of Donald Trump’s presidential election victory and coincided with a Federal Reserve interest rate cut, creating perfect conditions for institutional capital to flood into Bitcoin markets.

The unprecedented inflow surge pushed total spot Bitcoin ETF investments beyond $25 billion since their January launch, with no single Bitcoin ETF reporting outflows during this period of institutional enthusiasm. What makes this milestone particularly significant is that it demonstrates Bitcoin’s evolution from a speculative alternative asset to a mainstream institutional allocation, with the world’s largest asset manager leading the charge into digital currency exposure.

The Election Catalyst: Trump Victory Unlocks Institutional Capital

The timing of BlackRock’s record inflow was no coincidence. Following Donald Trump’s election victory on November 5, institutional investors responded with immediate and substantial allocations to Bitcoin ETFs, anticipating a dramatically different regulatory landscape for digital assets under the incoming administration. Trump’s campaign promises to establish a strategic Bitcoin reserve and position the United States as a global leader in cryptocurrency innovation created a permission structure for institutional capital that had been constrained by regulatory uncertainty during the Biden years.

Market participants report that institutional desks received a flood of orders immediately following the election results, with portfolio managers reallocating capital in anticipation of pro-crypto policies and clearer regulatory frameworks. The Trump victory effectively removed the regulatory overhang that had kept many institutional investors on the sidelines, despite growing recognition of Bitcoin’s potential as a hedge against inflation and currency debasement.

The institutional response was particularly dramatic given that BlackRock’s IBIT had actually experienced a $113 million outflow just days before the election, reflecting market uncertainty and risk-off positioning ahead of the vote. The rapid reversal from outflows to record inflows demonstrates how profoundly political outcomes can influence institutional cryptocurrency allocation decisions when regulatory clarity appears imminent.

Federal Reserve Accommodation: Rate Cuts Amplify Bitcoin Appeal

Adding to the favorable institutional environment, the Federal Reserve implemented a 25-basis point interest rate cut that coincided with the post-election period. The monetary policy accommodation removed another barrier to institutional Bitcoin investment by reducing the opportunity cost of holding non-yielding digital assets and increasing the relative attractiveness of inflation hedges.

Institutional investors, particularly those managing pension funds and endowments, had been monitoring Federal Reserve policy closely when considering Bitcoin allocations. The rate cut signaled that traditional monetary policy was becoming more accommodative, strengthening the case for including Bitcoin as a portfolio diversifier and inflation hedge. Lower interest rates also tend to weaken the U.S. dollar, making Bitcoin’s fixed supply and decentralized nature more appealing to institutional investors concerned about currency debasement.

The combination of political clarity from the Trump victory and monetary accommodation from the Fed created what many institutional investors describe as a “perfect storm” for Bitcoin adoption. With regulatory uncertainty diminishing and monetary policy becoming more favorable, the institutional barriers that had kept Bitcoin on the periphery of traditional portfolios began to crumble rapidly.

BlackRock’s Dominance: The World’s Largest Asset Manager Leads the Charge

BlackRock’s performance in the Bitcoin ETF market has been nothing short of extraordinary. With $27 billion in total inflows since its January launch, IBIT has quickly established itself as the dominant force in institutional Bitcoin exposure. The fund’s ability to attract $1.12 billion in a single day represents approximately 4% of its total cumulative inflows, demonstrating the scale of institutional confidence following the election.

What makes BlackRock’s success particularly remarkable is the speed with which the asset manager has built its Bitcoin ETF business. In less than a year, IBIT has become one of the most successful ETF launches in history, rivaling the performance of traditional ETF launches that took decades to achieve similar scale. The fund’s growth reflects both BlackRock’s distribution power and the pent-up institutional demand for regulated Bitcoin exposure.

Industry observers note that BlackRock’s entry into the Bitcoin ETF market has provided a stamp of legitimacy that has attracted institutional investors who might otherwise have remained cautious. The firm’s reputation for rigorous due diligence and compliance standards has helped address concerns about market manipulation, custody solutions, and regulatory compliance that had previously limited institutional participation in cryptocurrency markets.

Market Impact: Bitcoin Price Response and Trading Volume Surge

The institutional capital influx through BlackRock’s IBIT and other Bitcoin ETFs had immediate market impact. Bitcoin prices surged nearly 10% following the election results, trading above $76,000 as institutional buying pressure absorbed available supply. The price movement was accompanied by record trading volumes, with BlackRock’s IBIT alone experiencing $4.1 billion in trading volume on election day.

The market response demonstrated the growing influence that institutional ETF flows have on Bitcoin price discovery. Unlike previous retail-driven rallies, the post-election surge was characterized by measured, institutional-grade buying that created sustained upward pressure rather than speculative volatility. Derivatives markets remained orderly, with funding rates staying reasonable despite the rapid price appreciation.

Perhaps most importantly, the institutional inflows helped Bitcoin establish new support levels above $75,000, creating what technical analysts describe as a higher trading range that could support further gains. The ability of Bitcoin to absorb $1.38 billion in single-day ETF inflows without extreme price volatility suggests the market has matured significantly since previous cycles.

Competitive Landscape: Other ETFs Join the Institutional Wave

While BlackRock dominated the post-election inflows, other Bitcoin ETF providers also benefited from the institutional enthusiasm. Fidelity’s Wise Origin Bitcoin Fund (FBTC) attracted significant inflows, as did Grayscale’s Mini Bitcoin Trust. The broad-based nature of the inflows across multiple ETFs suggests that institutional investors are diversifying their Bitcoin ETF exposure rather than concentrating solely in BlackRock’s offering.

Industry data indicates that the total spot Bitcoin ETF market now manages approximately $105 billion in assets, with BlackRock controlling roughly 50% of the market. The remaining assets are distributed among Fidelity, Grayscale, ARK Invest, and other providers who have successfully carved out niches in the institutional Bitcoin market.

The competitive dynamics suggest that while BlackRock enjoys first-mover advantages and distribution power, there remains sufficient institutional demand to support multiple successful Bitcoin ETF providers. This competition benefits institutional investors by providing multiple options for accessing Bitcoin exposure with different fee structures, custodial arrangements, and operational approaches.

Looking Forward: Institutional Adoption Accelerates

The record inflows following the Trump election suggest that institutional Bitcoin adoption is entering a new phase of acceleration. With regulatory clarity on the horizon and the world’s largest asset manager demonstrating strong commitment to Bitcoin markets, institutional investors who remained on the sidelines may now feel compelled to establish positions.

Market participants report growing interest from pension funds, endowments, and insurance companies who are evaluating Bitcoin allocations for the first time. These institutional investors typically move more deliberately than hedge funds or family offices, but the combination of political clarity, monetary accommodation, and BlackRock’s market leadership has created a compelling case for action.

The institutional pipeline suggests that Bitcoin ETF inflows could remain robust through the remainder of 2024 and into 2025. As more institutions complete their due diligence processes and establish allocation frameworks, the cumulative institutional investment in Bitcoin could reach unprecedented levels, potentially reshaping the broader cryptocurrency market structure.

This article reflects market conditions and information available as of November 15, 2024.