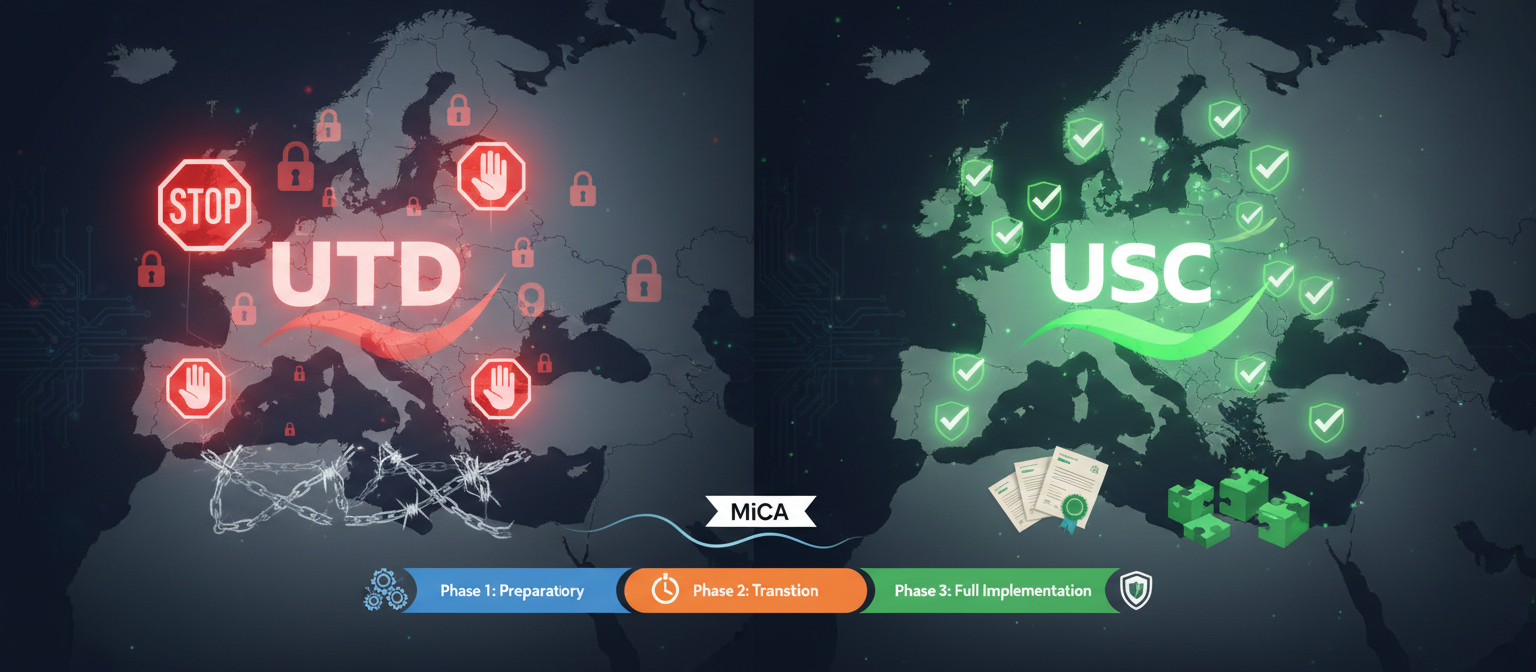

Coinbase has dealt a significant blow to Tether’s market dominance by delisting USDT and five other stablecoins across its European platforms, marking one of the most consequential regulatory compliance actions in cryptocurrency history. The move, effective December 13, comes as the European Union’s Markets in Crypto-Assets Regulation (MiCA) transforms from theoretical framework into enforceable reality, forcing exchanges to choose between the world’s largest stablecoin and access to the lucrative European market.

The delisting affects Coinbase Europe, Coinbase Germany, and Coinbase Custody International, immediately restricting trading, receiving, and holding capabilities for USDT, Paxos Standard (PAX), PayPal USD (PYUSD), Gemini Dollar (GUSD), GYEN, and Maker Protocol’s DAI. Only Circle’s USDC and Coinbase’s euro-pegged EURC remain fully operational, creating a dramatic market realignment that favors MiCA-compliant stablecoins and potentially reshapes global stablecoin dynamics.

MiCA’s Enforcement Moment: Theory Becomes Reality

The December 13 delisting represents the first major enforcement action demonstrating MiCA’s teeth as a regulatory framework. While the regulation was formally approved in 2023, its phased implementation reached a critical juncture in December 2024, with stablecoin compliance requirements becoming mandatory for exchanges operating in the European Economic Area.

Under MiCA’s stablecoin provisions, which technically took effect June 30, 2024, all stablecoins operating in the EU must be issued by entities holding appropriate e-money licenses from member state regulators. The regulation distinguishes between Asset-Referenced Tokens (ARTs) and E-Money Tokens (EMTs), both requiring robust capital requirements, transparency obligations, and consumer protection measures that many existing stablecoin issuers cannot meet without substantial operational changes.

What makes Coinbase’s action particularly significant is its timing and scope. Rather than waiting for the final December 30 compliance deadline, the exchange moved decisively on December 13, suggesting both regulatory pressure and strategic positioning. The preemptive action indicates that major exchanges are taking MiCA compliance seriously, potentially creating a cascade effect as other platforms evaluate their own stablecoin offerings.

The Stablecoin Hierarchy: Circle Gains, Tether Faces EU Exclusion

Coinbase’s delisting decision creates clear winners and losers in the stablecoin market. Circle’s USDC emerges as the primary beneficiary, having secured MiCA-compliant licensing and now enjoying exclusive access to Coinbase’s European user base. The exchange’s euro-pegged EURC also maintains full operational status, providing a regulatory bridge between traditional finance and digital assets.

Tether faces its most significant market access challenge to date. While USDT maintains its position as the world’s largest stablecoin with approximately $140 billion in market capitalization, exclusion from European exchanges represents a meaningful contraction of its available market. The delisting affects not only trading capabilities but also custody services, limiting European institutions’ ability to hold USDT through regulated channels.

The regulatory divergence between USDT and USDC reflects different strategic approaches to compliance. Circle pursued a proactive compliance strategy, securing necessary licensing and adapting its operational structure to meet MiCA requirements. Tether, meanwhile, has criticized aspects of MiCA regulation and indicated it’s developing “technology-based solutions” for the European market, suggesting a more measured approach to regulatory adaptation.

Market Impact: Beyond Immediate Trading Restrictions

The immediate impact of Coinbase’s delisting extends beyond simple trading restrictions. European users holding USDT and other delisted stablecoins face conversion decisions, potentially creating short-term market pressure as retail and institutional investors rebalance toward compliant alternatives. The requirement to either convert holdings to USDC/EURC or transfer assets to non-European platforms introduces friction that could accelerate the shift toward compliant stablecoins.

For institutional investors, the delisting creates operational complexities. Many institutional trading strategies rely on USDT’s liquidity and market penetration, particularly in derivatives markets and cross-border transactions. The need to adapt these strategies for European operations could drive institutional demand for USDC and other compliant alternatives, potentially shifting global stablecoin market dynamics over time.

The broader cryptocurrency market may also feel indirect effects. Stablecoins serve as primary liquidity conduits between traditional finance and digital asset markets, and any restriction on major stablecoins can impact overall market liquidity, trading volumes, and price discovery mechanisms. While the immediate impact may be contained to European operations, the precedent could influence regulatory approaches in other jurisdictions.

Regulatory Ripple Effects: Global Implications

MiCA’s enforcement through actions like Coinbase’s delisting carries implications beyond European borders. As one of the world’s most comprehensive cryptocurrency regulatory frameworks, MiCA serves as a potential template for other jurisdictions developing their own digital asset regulations. The successful implementation of stablecoin compliance requirements could encourage similar approaches in the UK, US, and Asian markets.

The regulatory clarity provided by MiCA, while disruptive in the short term, may ultimately benefit the cryptocurrency industry by establishing clear compliance pathways. Unlike the regulatory uncertainty that has characterized much of the cryptocurrency market’s development, MiCA provides specific requirements, timelines, and enforcement mechanisms that enable exchanges and issuers to plan strategic adaptations.

For global exchanges operating across multiple jurisdictions, MiCA creates a complex compliance matrix. Platforms must now navigate different regulatory requirements in various regions, potentially leading to market fragmentation where different stablecoins dominate different geographic areas. This fragmentation could create both challenges and opportunities for stablecoin issuers and exchanges seeking to serve global markets.

Industry Response: Adaptation and Strategic Positioning

Coinbase’s proactive compliance stance reflects a broader industry trend toward regulatory alignment rather than confrontation. Major exchanges increasingly recognize that sustainable growth requires cooperation with regulatory frameworks, even when such cooperation requires difficult business decisions like delisting popular assets.

Other exchanges are likely watching Coinbase’s actions closely while evaluating their own MiCA compliance strategies. The competitive dynamics could shift dramatically if exchanges maintain different stablecoin offerings based on their interpretation of compliance requirements. This divergence could create market inefficiencies but also opportunities for exchanges that successfully navigate the regulatory landscape.

Tether’s response to the delisting suggests the company is developing long-term strategies for European market access. While criticizing what it describes as “rushed actions,” Tether acknowledges the need for technological solutions to address MiCA requirements. The company’s ongoing operations in other markets and its massive market capitalization provide it with resources to develop compliant alternatives that could eventually restore European market access.

Looking Forward: The New Stablecoin Landscape

As MiCA implementation continues through 2025, the stablecoin market will likely continue evolving toward greater regulatory compliance. Coinbase’s December 13 delisting may represent the first of many similar actions as exchanges and issuers adapt to the new regulatory environment. The trend toward compliant stablecoins could accelerate, potentially reshaping global stablecoin market share distribution.

For European cryptocurrency users, the transition period may create some inconvenience but ultimately promises greater consumer protection and market stability. The regulatory clarity provided by MiCA could attract more institutional participants to European cryptocurrency markets, potentially offsetting any short-term disruptions caused by stablecoin delistings.

The stablecoin industry’s adaptation to MiCA requirements may also drive innovation in compliance technology and operational processes. The need to meet European regulatory standards could inspire new approaches to transparency, reserve management, and consumer protection that benefit the entire cryptocurrency ecosystem.

This article reflects market conditions and regulatory developments as of December 15, 2024.