Ethereum’s Layer-2 scaling solutions have achieved a historic milestone, processing over $1.4 trillion in transaction volume during September 2025 as the ecosystem matures into a sophisticated financial infrastructure capable of supporting global institutional demand. The remarkable achievement demonstrates how Ethereum’s scalability challenges are being solved through a multi-layered approach that combines technological innovation with growing institutional confidence in decentralized finance.

The $1.4 trillion monthly volume represents a 300% increase from the same period last year and underscores the rapid maturation of Layer-2 technologies including Arbitrum, Optimism, zkSync, and StarkNet. These networks have evolved from experimental scaling solutions into production-ready financial infrastructure that processes transactions at a fraction of the cost and with significantly greater throughput than the Ethereum mainnet.

Scaling Revolution Transforms Ethereum Economics

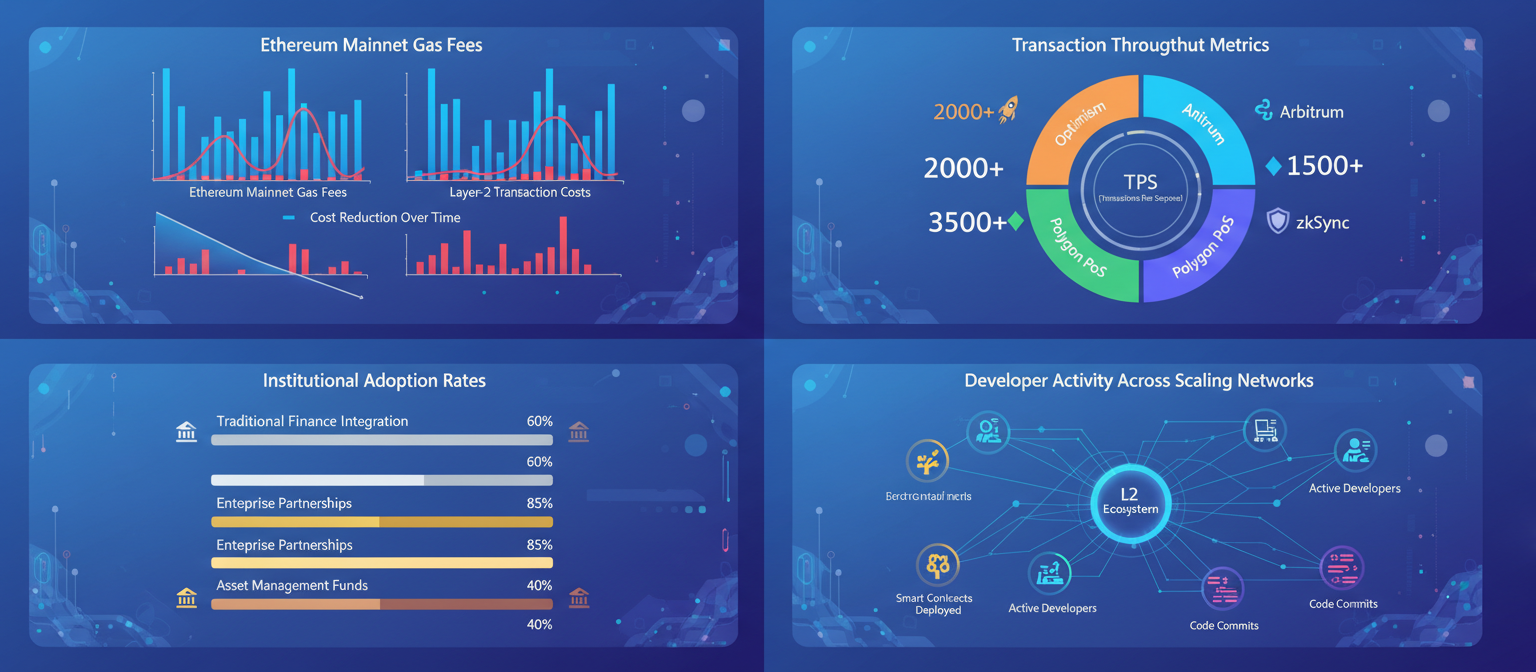

The explosive growth in Layer-2 transaction processing has fundamentally transformed Ethereum’s economic model and value proposition. Where users once faced gas fees exceeding $100 for simple token transfers during periods of network congestion, Layer-2 solutions now enable the same transactions for pennies while maintaining security guarantees inherited from Ethereum mainnet.

This dramatic reduction in transaction costs has unlocked new use cases that were previously economically unfeasible on Ethereum. High-frequency trading, micro-transactions, decentralized social media applications, and complex DeFi strategies now operate efficiently on Layer-2 networks, creating a vibrant ecosystem of applications that process millions of transactions daily without the cost barriers that once limited Ethereum’s accessibility.

The economic impact extends beyond individual users to institutional participants who require predictable, low-cost transaction processing for large-scale operations. Hedge funds, market makers, and financial institutions increasingly use Layer-2 networks for arbitrage, market making, and treasury management activities, contributing to the dramatic increase in transaction volume.

Technology Innovation Drives Performance Gains

The success of Layer-2 scaling solutions stems from continuous technological innovation across multiple scaling approaches. Optimistic rollups like Arbitrum and Optimism have demonstrated the effectiveness of fraud proof systems, while zero-knowledge rollups including zkSync and StarkNet have proven the viability of validity proofs for maintaining security while achieving massive throughput improvements.

Recent technological breakthroughs have addressed key limitations that previously constrained Layer-2 adoption. Enhanced data availability solutions, improved cross-layer communication protocols, and more efficient batch submission mechanisms have all contributed to better performance and user experience. The result is a new generation of Layer-2 networks that approach or even exceed the performance of traditional financial payment systems.

Innovation in developer tooling has also played a crucial role in Layer-2 adoption. Improved smart contract development frameworks, better debugging tools, and comprehensive testing suites have made it easier for developers to build and deploy applications on Layer-2 networks. This technical maturity has attracted established financial institutions and technology companies to the Ethereum ecosystem.

Institutional Adoption Accelerates

The dramatic increase in Layer-2 transaction volume reflects growing institutional adoption of Ethereum-based financial infrastructure. Major banks, asset managers, and financial technology companies have established significant operations on Layer-2 networks, attracted by the combination of Ethereum’s security guarantees and Layer-2’s performance advantages.

Institutional DeFi protocols now routinely process billions of dollars in daily volume across multiple Layer-2 networks. These protocols offer sophisticated financial services including lending, borrowing, derivatives trading, and asset management that compete directly with traditional financial services. The ability to operate on Layer-2 networks with low transaction costs and high throughput makes these services economically viable at institutional scale.

The institutional presence extends beyond DeFi to include enterprise applications that leverage Ethereum’s smart contract capabilities for supply chain management, digital identity, and tokenization of real-world assets. Layer-2 networks provide the performance and cost efficiency needed for these applications to operate at global scale.

Network Effects and Ecosystem Growth

The growth of Layer-2 transaction processing has created powerful network effects that reinforce Ethereum’s position as the leading smart contract platform. As more users and applications migrate to Layer-2 networks, the ecosystem becomes more valuable for all participants, creating a virtuous cycle of adoption and development.

Cross-chain interoperability solutions have strengthened these network effects by enabling seamless movement of assets and data between different Layer-2 networks. Projects like LayerZero, Synapse, and Multichain have developed sophisticated bridging protocols that maintain security while enabling users to access liquidity and applications across the entire Layer-2 ecosystem.

The composability of Layer-2 networks has also contributed to ecosystem growth. Developers can build applications that leverage multiple Layer-2 networks simultaneously, creating complex financial products and services that weren’t possible on a single network. This composability has fostered innovation and attracted talented developers to the Ethereum ecosystem.

Competitive Landscape and Market Position

Ethereum’s Layer-2 solutions have established a dominant position in the competitive landscape of blockchain scaling technologies. While alternative smart contract platforms have attempted to differentiate themselves through higher base layer throughput, Ethereum’s approach of scaling through Layer-2 solutions has proven more successful at maintaining decentralization while achieving performance improvements.

The success of Ethereum’s Layer-2 ecosystem has created significant challenges for competing platforms. Where projects like Solana, Avalanche, and Polygon once competed with Ethereum on throughput and cost, they now face an ecosystem that combines Ethereum’s security and network effects with Layer-2 performance advantages. This competitive pressure has forced alternative platforms to differentiate themselves in other ways or risk losing market share to Ethereum’s Layer-2 solutions.

The institutional preference for Ethereum’s Layer-2 ecosystem further strengthens its competitive position. Financial institutions and large enterprises typically prioritize security, regulatory compliance, and established ecosystems over raw performance metrics. Ethereum’s combination of mainnet security guarantees and Layer-2 performance advantages makes it the preferred choice for institutional blockchain applications.

Future Challenges and Opportunities

Despite the remarkable success of Layer-2 scaling solutions, significant challenges remain on the path to full Ethereum ecosystem maturation. Cross-layer liquidity fragmentation continues to pose challenges for users and developers who must navigate multiple Layer-2 networks with different assets and applications. Solutions like unified liquidity protocols and improved bridging mechanisms are needed to address this fragmentation.

Security considerations also remain paramount as Layer-2 networks handle increasingly large transaction volumes and value transfers. The security of Layer-2 networks ultimately depends on Ethereum mainnet, making mainnet security and decentralization crucial for the entire ecosystem. Continued investment in mainnet scaling and security is essential for supporting Layer-2 growth.

Regulatory uncertainty presents another challenge for Layer-2 adoption. As Layer-2 networks process increasing transaction volumes and handle more sophisticated financial applications, regulatory scrutiny is likely to increase. Clear regulatory frameworks that recognize the unique characteristics of Layer-2 networks will be essential for continued institutional adoption.

Looking forward, the convergence of Layer-2 technologies and the development of more sophisticated cross-layer solutions promise to further enhance Ethereum’s scalability and usability. Projects working on unified Layer-2 protocols and improved cross-chain communication are laying the groundwork for the next phase of Ethereum’s evolution as a global financial infrastructure.

This article reflects Layer-2 network performance and ecosystem development as of September 15, 2025.