Lido, the dominant liquid staking protocol on Ethereum, has unveiled its groundbreaking V3 upgrade, introducing a modular staking infrastructure designed specifically for institutional investors and sophisticated staking strategies. The upgrade, which launched on February 10, 2025, represents the most significant evolution in Ethereum staking since the protocol’s initial inception, potentially transforming how institutions participate in network validation.

The stVault Revolution

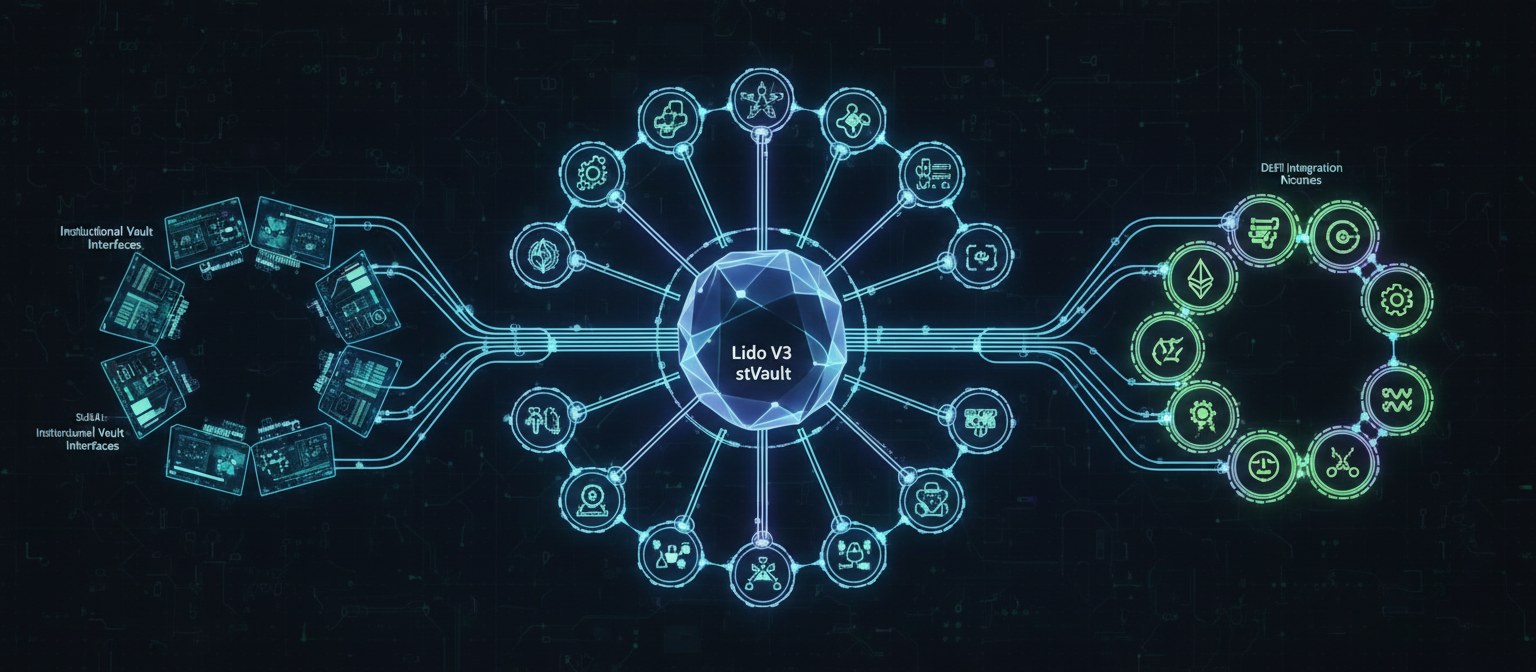

At the heart of Lido V3 lies the innovative “stVault” system – modular smart contracts that enable institutions to create fully customized staking setups tailored to their specific requirements. This architectural departure from traditional liquid staking marks a fundamental shift in how sophisticated market participants can engage with Ethereum’s proof-of-stake consensus mechanism.

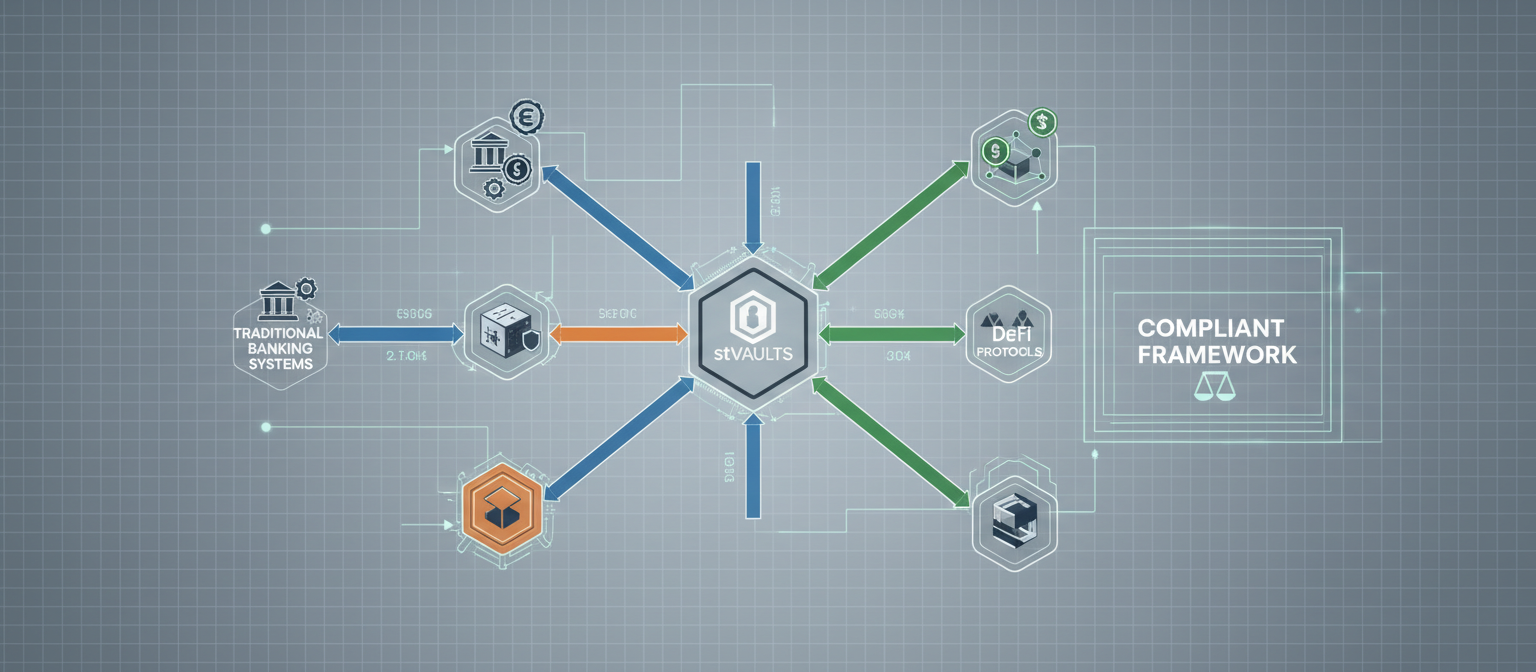

The stVault system allows institutional stakers to maintain operational control while benefiting from Lido’s battle-tested infrastructure. Unlike previous versions that offered a one-size-fits-all approach, V3 enables institutions to select specific node operators, implement customized validator configurations, and design staking strategies that align with their compliance requirements and risk management frameworks.

Institutional-Grade Features

Lido V3 addresses several critical pain points that have prevented broader institutional adoption of Ethereum staking:

Compliance-Ready Architecture: The stVault system is designed from the ground up to meet institutional compliance requirements, including segregation of duties, audit trails, and integration with existing institutional custody solutions.

Customizable Node Operator Selection: Institutions can choose specific node operators or create bespoke arrangements, enabling them to align their staking operations with their security requirements and due diligence standards.

Enhanced Liquidity Management: stVaults provide sophisticated liquidity management tools, allowing institutions to optimize their staked ether (stETH) positions while maintaining access to liquidity when needed.

Non-Custodial Control: Unlike traditional liquid staking where users surrender control of their assets, V3 enables institutions to maintain direct control over their staking operations through the vault system.

Market Context and Timing

The launch of Lido V3 comes at a critical moment for the Ethereum ecosystem and broader cryptocurrency market. With over $25.5 billion in total value locked, Lido currently dominates the liquid staking market, controlling more than 50% of all liquid staked ether.

The timing is particularly significant given the increasing institutional interest in Ethereum staking following the 2024 U.S. presidential election, which has created expectations for a more favorable regulatory environment for digital assets. Industry analysts suggest that the potential approval of staked Ether ETFs could further accelerate institutional adoption, making Lido V3’s infrastructure improvements particularly timely.

Technical Architecture Deep Dive

The stVault system represents a sophisticated engineering achievement that balances flexibility, security, and composability:

Modular Design: Each stVault operates as an independent smart contract that can be customized for specific institutional needs while maintaining interoperability with the broader Lido ecosystem.

Validator Management: Institutions can manage their validator key distribution and operational security within the vault framework, integrating with existing key management systems and security protocols.

Yield Optimization: The vault architecture enables sophisticated yield optimization strategies, allowing institutions to maximize their staking returns while managing risk parameters.

DeFi Integration: stVaults seamlessly integrate with decentralized finance protocols, enabling institutions to leverage their stETH positions across the broader DeFi ecosystem while maintaining institutional-grade security.

Competitive Landscape Impact

Lido V3’s launch significantly impacts the competitive landscape for Ethereum staking services. The upgrade positions Lido to capture a larger share of the growing institutional market, potentially accelerating the consolidation of staking services around established, battle-tested protocols.

Traditional custodial staking solutions and newer competitors will need to respond with their own institutional-grade features to remain competitive. The upgrade also puts pressure on other liquid staking protocols to enhance their offerings and address the sophisticated requirements of institutional clients.

Risk Management Considerations

While Lido V3 introduces powerful new capabilities, institutional users must carefully consider several risk factors:

Smart Contract Risk: As with any DeFi protocol, stVaults carry smart contract risk. However, Lido’s extensive track record and multiple security audits provide confidence in the protocol’s security model.

Slashing Risk: Ethereum’s proof-of-stake system includes slashing penalties for validator misbehavior. Institutions must implement robust operational procedures to minimize this risk.

Market Risk: stETH positions are subject to market volatility and potential de-pegging events during periods of market stress.

Regulatory Risk: The evolving regulatory landscape for digital assets and staking services remains a significant consideration for institutional participants.

Community and Ecosystem Response

The Ethereum community has responded positively to Lido V3, recognizing the upgrade’s potential to accelerate institutional adoption and strengthen network security. DeFi protocols are actively working to integrate stVault functionality, recognizing the potential for increased capital flows from institutional participants.

Node operators have also welcomed the upgrade, noting that the stVault system creates new opportunities for specialized services and institutional partnerships. Several leading node operators have already announced custom staking solutions built on the V3 infrastructure.

Future Roadmap and Development

Lido’s development team has outlined an ambitious roadmap for V3’s continued evolution:

Q2 2025: Expansion of stVault customization options and integration with additional custody solutions.

Q3 2025: Launch of advanced governance features enabling institutional participants to influence protocol development.

Q4 2025: Integration with emerging Ethereum scaling solutions and layer-2 networks.

Implications for Ethereum’s Security Model

Lido V3 has significant implications for Ethereum’s network security and decentralization. By making institutional staking more accessible and operationally manageable, the upgrade could potentially increase the amount of ether secured through professional, well-capitalized staking operations.

However, the continued dominance of Lido in the liquid staking market also raises important questions about Ethereum’s decentralization. Protocol developers and community governance will need to carefully monitor and manage these centralization risks as institutional adoption accelerates.

Looking Ahead: The Future of Institutional Staking

Lido V3 represents more than just a technical upgrade – it signals the maturation of Ethereum’s staking ecosystem and the increasing sophistication of institutional participation in blockchain networks. The stVault architecture provides a template for how other protocols might approach institutional integration, balancing the need for customization and compliance with the principles of decentralization and openness.

As institutional adoption of Ethereum staking continues to accelerate, Lido V3 is positioned to play a central role in bridging the gap between traditional financial institutions and the blockchain ecosystem. The upgrade’s success will likely influence how other protocols approach institutional design and could serve as a model for institutional infrastructure across the broader cryptocurrency landscape.

The launch of Lido V3 marks a significant milestone in Ethereum’s evolution from a niche technology to a mainstream financial infrastructure. As institutional participants increasingly embrace Ethereum staking, the protocol’s ability to provide sophisticated, compliant, and secure infrastructure will be crucial for maintaining network security and supporting continued growth.

This article reflects information available as of February 10, 2025, and does not include subsequent protocol developments or market changes.