At least 14 U.S. states have introduced or are preparing to introduce Strategic Bitcoin Reserve legislation this month, creating a wave of state-level cryptocurrency adoption that may move faster than anticipated federal efforts. The coordinated push, confirmed by Bitcoin policy advocate Dennis Porter on January 7, represents the most significant state government embrace of digital assets in American history and could fundamentally reshape how public treasuries approach cryptocurrency.

The January surge in state Bitcoin reserve bills follows President Trump’s election victory in November and his campaign promises to establish a federal Strategic Bitcoin Reserve. Rather than waiting for Washington to act, state legislatures are taking the lead—introducing concrete proposals that would allow treasuries to allocate public funds into Bitcoin as a hedge against inflation and dollar debasement.

New Hampshire and North Dakota Lead January Wave

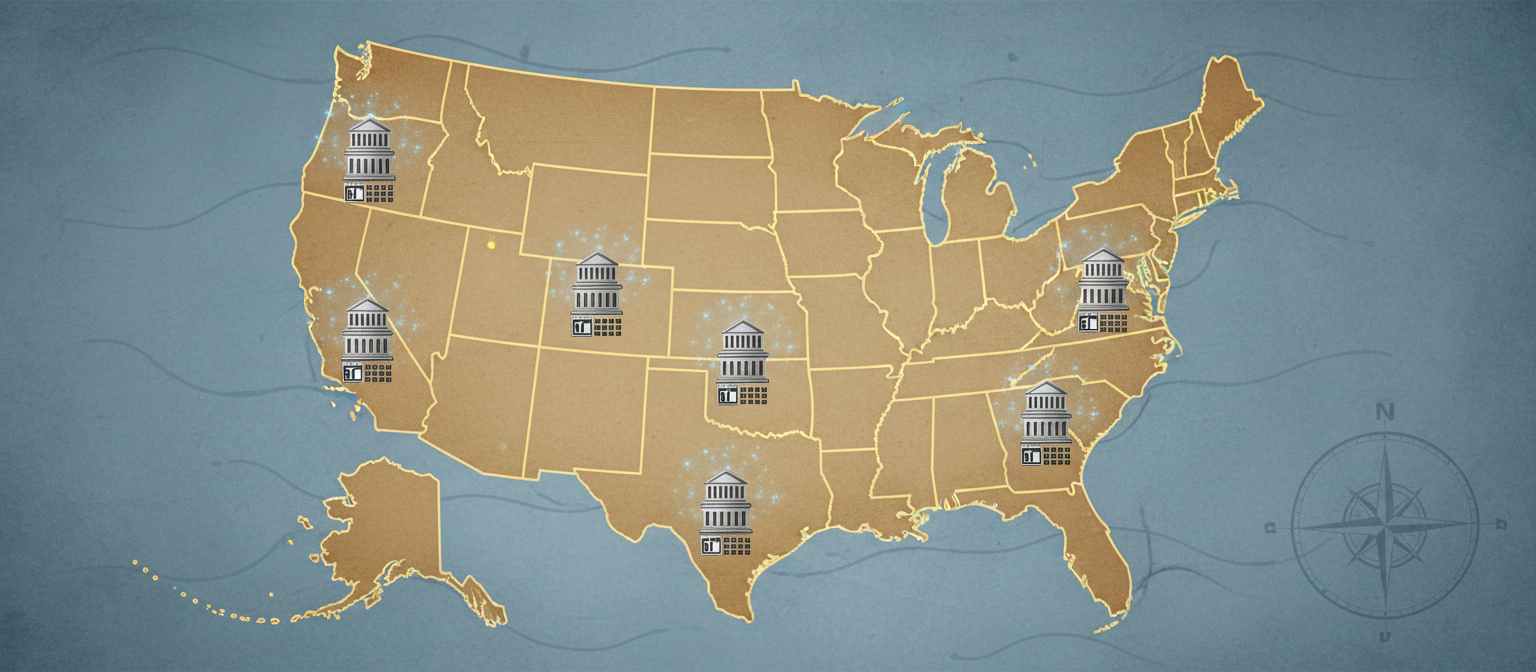

On January 10, New Hampshire and North Dakota became the latest states to formally introduce Bitcoin reserve legislation, joining a rapidly growing movement that includes Arizona, Utah, Illinois, Indiana, Kansas, Massachusetts, Missouri, Montana, Ohio, Oklahoma, South Dakota, and Wyoming.

New Hampshire Representative Keith Ammon introduced legislation enabling the state Treasury to invest in Bitcoin, strategically using the term “digital assets” rather than explicitly naming Bitcoin to reduce political friction. The approach reflects a calculated effort to build broad coalition support for what remains a novel concept in state treasury management.

North Dakota’s HCR 3001, introduced by Representatives Nathan Toman and Josh Christy along with Senator Jeff Barta, requires portions of state funds to be invested in digital assets and precious metals. With 11 sponsors already backing the measure, the North Dakota bill demonstrates significant legislative support for diversifying state holdings beyond traditional assets.

The timing of these introductions is deliberate. Most state legislatures operate on limited session schedules, creating a compressed timeline for advancing legislation. According to Dennis Porter, president of Satoshi Action Education, states will either have strategic Bitcoin reserves by summer or not at all, as legislative windows close for the year in many jurisdictions.

What the State Bills Actually Propose

While details vary by jurisdiction, most state Bitcoin reserve proposals share common structural elements designed to balance innovation with prudent treasury management.

The bills typically allow state treasurers or comptrollers to allocate up to 10 percent of designated public funds—such as general funds, rainy day reserves, or pension investments—into digital assets. This 10 percent cap provides meaningful exposure while limiting downside risk from Bitcoin’s well-documented price volatility.

Crucially, most proposals include market capitalization requirements that effectively restrict eligible assets to Bitcoin alone. Oklahoma Representative Cody Maynard’s bill, for example, specifies that only digital assets with market caps exceeding 500 billion dollars qualify for state treasury investment. With Bitcoin’s current market capitalization hovering around 2 trillion dollars and Ethereum at approximately 400 billion dollars, only Bitcoin meets this threshold today.

The market cap requirement serves multiple purposes: it ensures states invest only in highly liquid, established assets; it provides objective criteria that remove political considerations from asset selection; and it creates a built-in mechanism for treasury policy to adapt if other digital assets achieve comparable scale and stability over time.

Massachusetts Senator Peter Duran’s bill allows up to 10 percent of the state’s rainy day fund to be invested in Bitcoin or another qualifying cryptocurrency, potentially representing hundreds of millions in state Bitcoin purchases if enacted. The bill frames Bitcoin as a strategic hedge—an alternative store of value that isn’t subject to the same monetary policy decisions affecting traditional dollar-denominated reserves.

Why States Are Moving Faster Than Washington

The state-level Bitcoin reserve movement is outpacing federal efforts for several practical and political reasons that highlight the structural differences between state and federal governance.

State legislatures face fewer institutional barriers to innovation than Congress. Bills can move from introduction to passage in a single legislative session, whereas federal legislation often requires years of committee hearings, stakeholder negotiations, and political consensus-building across deeply divided chambers. The streamlined state legislative process allows for faster experimentation with new treasury approaches.

Political alignment also plays a significant role. The state Bitcoin reserve movement is predominantly occurring in Republican-controlled legislatures where cryptocurrency policy enjoys strong support among elected officials and constituents. These states view Bitcoin adoption as both a financial strategy and a political statement—embracing digital assets while Washington debates regulatory frameworks.

The Trump administration’s pro-cryptocurrency stance has created political permission for state-level action. With the incoming president promising to make America the world’s cryptocurrency capital and establish a federal Strategic Bitcoin Reserve, state lawmakers no longer fear federal preemption or regulatory backlash for treasury Bitcoin purchases. The anticipated shift in federal regulatory posture from enforcement-heavy to innovation-friendly reduces the political risk of state Bitcoin adoption.

From a treasury management perspective, states recognize they may achieve better entry points by moving now rather than waiting for potential federal action. If the federal government ultimately establishes a Strategic Bitcoin Reserve and begins accumulating significant quantities, the resulting price impact could make later state purchases considerably more expensive. Early-mover states position themselves to acquire Bitcoin at prices that may prove attractive in retrospect.

The bipartisan nature of some proposals also facilitates state action. While the movement is led by Republican-majority legislatures, individual Democratic legislators like Massachusetts Senator Duran are sponsoring bills, suggesting cryptocurrency adoption is cutting across traditional party lines in some jurisdictions.

Michigan and Wisconsin: Already Invested

The state-level Bitcoin adoption movement isn’t entirely theoretical—some states have already taken positions in cryptocurrency through pension fund investments, demonstrating the practical implementation of public sector digital asset exposure.

Michigan and Wisconsin have both invested portions of state pension funds in cryptocurrency exchange-traded funds, providing existing exposure to Bitcoin price movements through regulated investment vehicles. These pension investments serve as proof-of-concept for state Bitcoin holdings, demonstrating that public sector fiduciaries can establish cryptocurrency positions within existing regulatory and fiduciary frameworks.

The pension fund approach differs from the Strategic Bitcoin Reserve proposals in important ways. ETF investments provide indirect exposure through regulated securities rather than direct Bitcoin holdings. Pension managers make allocation decisions based on standard investment committee processes rather than legislative mandate. And pension investments typically represent smaller percentage allocations than the 10 percent caps proposed in strategic reserve legislation.

Nevertheless, the Michigan and Wisconsin pension investments establish precedent that states can hold Bitcoin-related assets without legal or fiduciary complications. As Strategic Bitcoin Reserve legislation advances through state houses this winter, proponents point to these pension investments as evidence that cryptocurrency exposure is compatible with public sector treasury management responsibilities.

The Broader Bitcoin Adoption Context

The state-level Bitcoin reserve movement is occurring against a backdrop of unprecedented institutional cryptocurrency adoption that extends well beyond government treasuries.

Bitcoin is trading near all-time highs following its historic breach of 100,000 dollars in December. Spot Bitcoin ETFs have accumulated over 129 billion dollars in assets since their January 2024 approval, demonstrating sustained institutional demand. And corporate Bitcoin adoption continues to accelerate, led by MicroStrategy’s aggressive accumulation strategy that has made the company the world’s largest corporate Bitcoin holder.

For state treasurers watching these developments, Bitcoin reserve legislation represents an opportunity to participate in what many view as a fundamental shift in how institutions approach store-of-value assets. The 21 million coin supply cap, combined with increasing demand from institutional investors, creates supply-demand dynamics that advocates argue will drive long-term appreciation.

The state Bitcoin movement also reflects growing concerns about federal fiscal sustainability and dollar purchasing power. With national debt exceeding 36 trillion dollars and ongoing deficit spending, some state officials view Bitcoin as a non-sovereign asset that provides diversification from dollar-denominated holdings potentially subject to debasement through monetary expansion.

What Comes Next

The coming weeks will determine whether state Bitcoin reserve legislation translates from proposals into enacted law. Several factors will influence outcomes across the 14-plus states with active or pending bills.

Legislative calendar constraints create urgency. States with limited legislative sessions must move bills through committee, floor votes, and gubernatorial approval processes within compressed timeframes. Bills that don’t advance quickly may die as sessions end, requiring reintroduction in future years.

Public education will be critical. Bitcoin reserve proposals ask legislators to approve a treasury approach that has no precedent in state government. Sponsors must educate colleagues about Bitcoin’s characteristics, address volatility concerns, and explain why digital asset diversification makes sense for state treasuries. The success of these education efforts will likely determine which bills advance beyond committee.

Governor support matters significantly. Even bills that pass state legislatures face potential vetoes from governors who may be more cautious about untested treasury strategies. Building gubernatorial buy-in early in the legislative process increases the likelihood of bills ultimately becoming law.

Market conditions could influence legislative momentum. If Bitcoin experiences significant price declines during state legislative debates, support may weaken as volatility concerns become more salient. Conversely, continued price strength and positive institutional adoption news could build political momentum for passage.

Federal developments may also impact state efforts. If the Trump administration announces concrete plans for a federal Strategic Bitcoin Reserve or issues supportive regulatory guidance, state legislatures may feel additional confidence to proceed with their own programs.

Regardless of how many of the 14-plus state bills ultimately pass, the January 2025 surge in Strategic Bitcoin Reserve legislation marks a watershed moment for government cryptocurrency adoption. States are no longer debating whether Bitcoin has a role in public finance—they’re drafting specific proposals to put taxpayer dollars into digital assets and competing to be among the first to establish formal reserves.

This article reflects news and developments as of January 31, 2025.