Texas Governor Greg Abbott signed Senate Bill 21 into law today, establishing the Texas Strategic Bitcoin Reserve and cementing the Lone Star State’s position as a leader in cryptocurrency adoption at the state level. The legislation, which takes effect immediately, makes Texas one of the first U.S. states to formally recognize Bitcoin as a strategic asset worthy of government reserves.

What the Law Creates

Under SB 21, Texas establishes a Bitcoin reserve fund that will operate outside the state treasury under the custody of the Texas Comptroller of Public Accounts. The law explicitly recognizes Bitcoin and other qualifying cryptocurrencies as “assets with strategic potential for enhancing the state’s financial resilience”—a significant departure from the skepticism that has characterized much government policy toward digital assets.

The reserve structure gives the Comptroller authority to acquire, hold, and manage Bitcoin on behalf of the state, creating an institutional framework similar to how states manage other strategic assets like precious metals or energy reserves. Critically, the legislation doesn’t mandate specific acquisition amounts or timelines, instead granting discretionary authority to build reserves as market conditions and state finances permit.

The $500 Billion Threshold

Not every cryptocurrency qualifies for inclusion in Texas’s strategic reserve. SB 21 establishes clear eligibility criteria: only digital assets with an average market capitalization of at least $500 billion over the most recent 24-month period can be held in the reserve.

This threshold effectively limits the reserve to Bitcoin—the only cryptocurrency currently meeting this requirement with its market cap hovering around $2.3 trillion. Ethereum, the second-largest cryptocurrency, maintains a market cap of approximately $550 billion but would need to sustain that level for two years to qualify under the law’s language.

The market cap requirement serves multiple purposes: it ensures the reserve holds only highly liquid, established assets; it provides objective criteria that remove political considerations from asset selection; and it creates a built-in mechanism for the reserve to adapt if other digital assets achieve comparable scale and stability.

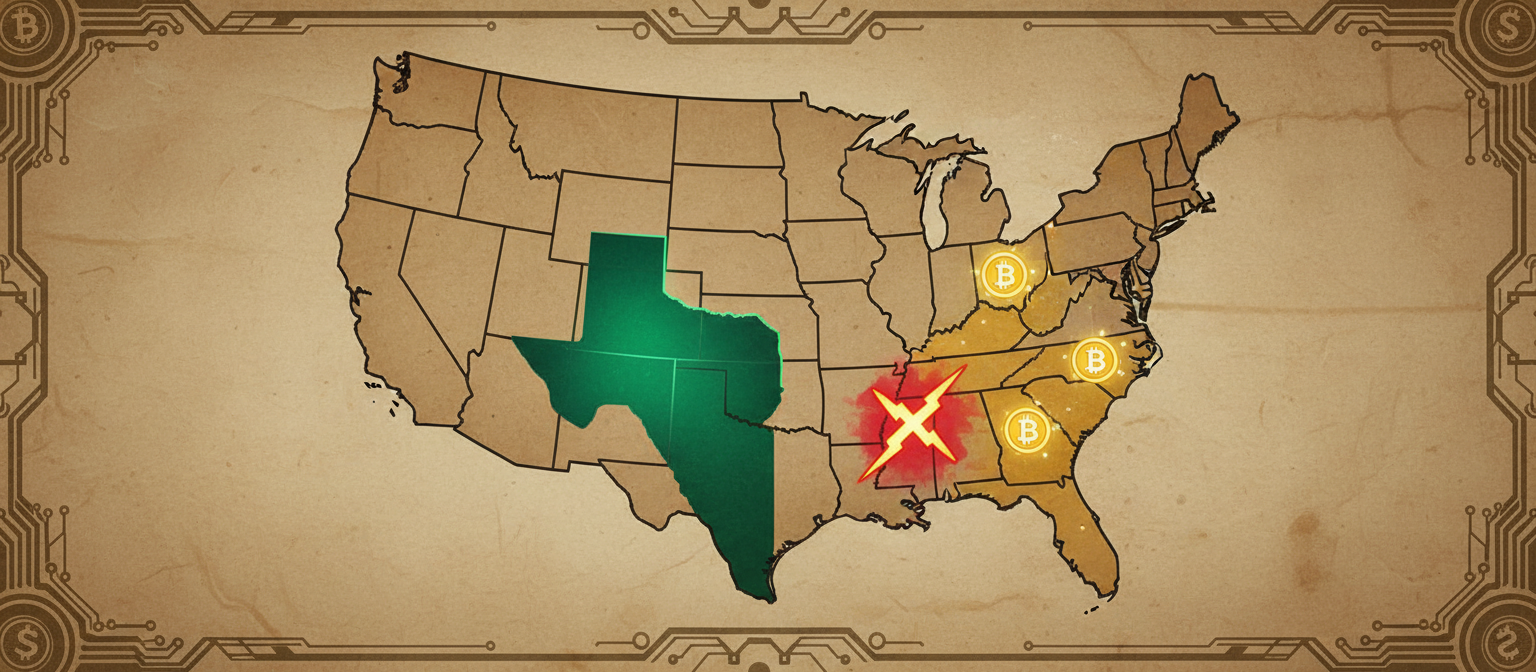

A Contentious State Bitcoin Movement

Texas’s move comes amid a broader—and politically divided—push for state-level Bitcoin reserves across the country. The legislation follows similar efforts in multiple states, with varying degrees of success:

New Hampshire: Became an early mover in state Bitcoin reserves, though details on implementation remain limited.

Arizona: Just weeks ago, Governor Katie Hobbs vetoed House Bill 2324 on July 1, which would have created a Bitcoin reserve funded by proceeds from seized cryptocurrency. Governor Hobbs cited concerns that the measure would disincentivize local law enforcement cooperation on digital asset forfeiture cases, highlighting the complex interplay between cryptocurrency policy and existing law enforcement funding structures.

Wyoming: While not establishing a Bitcoin reserve per se, Wyoming continues advancing its state-issued stablecoin initiative. The Wyoming Stable Token Commission released an updated timeline on June 19 for the Wyoming Stable Token (WYST), demonstrating alternative approaches to state-level digital asset adoption.

The divergent approaches reflect genuine policy debates about whether states should hold volatile assets like Bitcoin, how reserves should be funded, and what precedent such moves set for state treasury management.

Implications for Bitcoin Legitimacy

Texas’s decision carries weight beyond the immediate creation of a reserve fund. As the nation’s second-largest state economy—larger than Canada’s—Texas brings significant credibility to the argument that Bitcoin represents a legitimate store of value for institutional portfolios.

Several dynamics make this development significant:

Political Signal: Governor Abbott’s signature sends a clear message that Bitcoin has matured beyond speculative trading to become an asset worthy of government balance sheets. This legitimization could influence other states, particularly those with conservative fiscal philosophies similar to Texas’s.

Precedent for Institutions: If a state government can justify holding Bitcoin as a strategic reserve, the rationale becomes easier for corporate treasuries, pension funds, and other institutions that have hesitated to allocate capital to digital assets.

Regulatory Clarity: The legislation’s clear definitions and criteria provide a template other states can reference, potentially accelerating similar initiatives elsewhere while establishing common standards.

Market Dynamics: While the law doesn’t specify immediate purchase requirements, even modest state acquisition would represent a new category of Bitcoin demand—government buyers with long time horizons and strategic rather than speculative intent.

The Broader Context

This move aligns with Texas’s broader strategy of positioning itself as the most cryptocurrency-friendly state in the nation. The state already attracts significant Bitcoin mining activity, offers favorable regulatory treatment for digital asset businesses, and has taken steps to clarify the legal status of cryptocurrencies under state law.

The timing is also noteworthy. SB 21 becomes law at a moment when federal cryptocurrency policy remains in flux, with debates ongoing about appropriate regulatory frameworks for digital assets. By establishing its own strategic reserve, Texas is effectively making a bet that Bitcoin will become increasingly integrated into the financial system regardless of near-term regulatory uncertainties.

What Comes Next

The immediate question is how aggressively Texas will actually fund its new reserve. The legislation provides authority but not mandate, leaving practical decisions to the Comptroller’s office and future budget processes. Given current political dynamics, it seems likely Texas will start conservatively, perhaps allocating a small percentage of existing reserves to Bitcoin as a pilot program.

Equally important will be how other states respond. Texas’s move almost certainly ensures that Bitcoin reserves will become a topic in state legislatures nationwide over the coming year. Some will follow Texas’s lead; others may take Arizona’s path and reject the concept. The resulting patchwork of state policies will create natural experiments that could inform federal policy debates.

For Bitcoin itself, Texas’s decision represents another incremental step toward mainstream institutional adoption. While one state’s reserve won’t dramatically move global markets, it contributes to a broader narrative shift: Bitcoin is transitioning from speculative asset to strategic reserve, from fringe experiment to financial infrastructure.

Whether that narrative proves correct will ultimately depend on Bitcoin’s performance over the coming years. But today, Texas has placed a meaningful bet that it will.