The United Kingdom published comprehensive draft legislation yesterday establishing a regulatory framework for cryptocurrency exchanges, custodians, and dealers—marking one of the most significant crypto regulatory developments in a major financial center this year. The Financial Services and Markets Act 2000 (Regulated Activities and Miscellaneous Provisions) (Cryptoassets) Order 2025 brings digital asset firms under the UK Financial Conduct Authority’s direct oversight, creating clear rules for an industry that has operated largely without formal regulation.

Chancellor Rachel Reeves announced the framework during UK Fintech Week, positioning it as part of the government’s “Plan for Change” to make Britain “the best place in the world to innovate—and the safest place for consumers.” The timing reflects growing urgency: cryptocurrency ownership in the UK has surged from 4 percent of the population in 2021 to 12 percent in 2024, creating millions of retail investors who currently operate with limited regulatory protection.

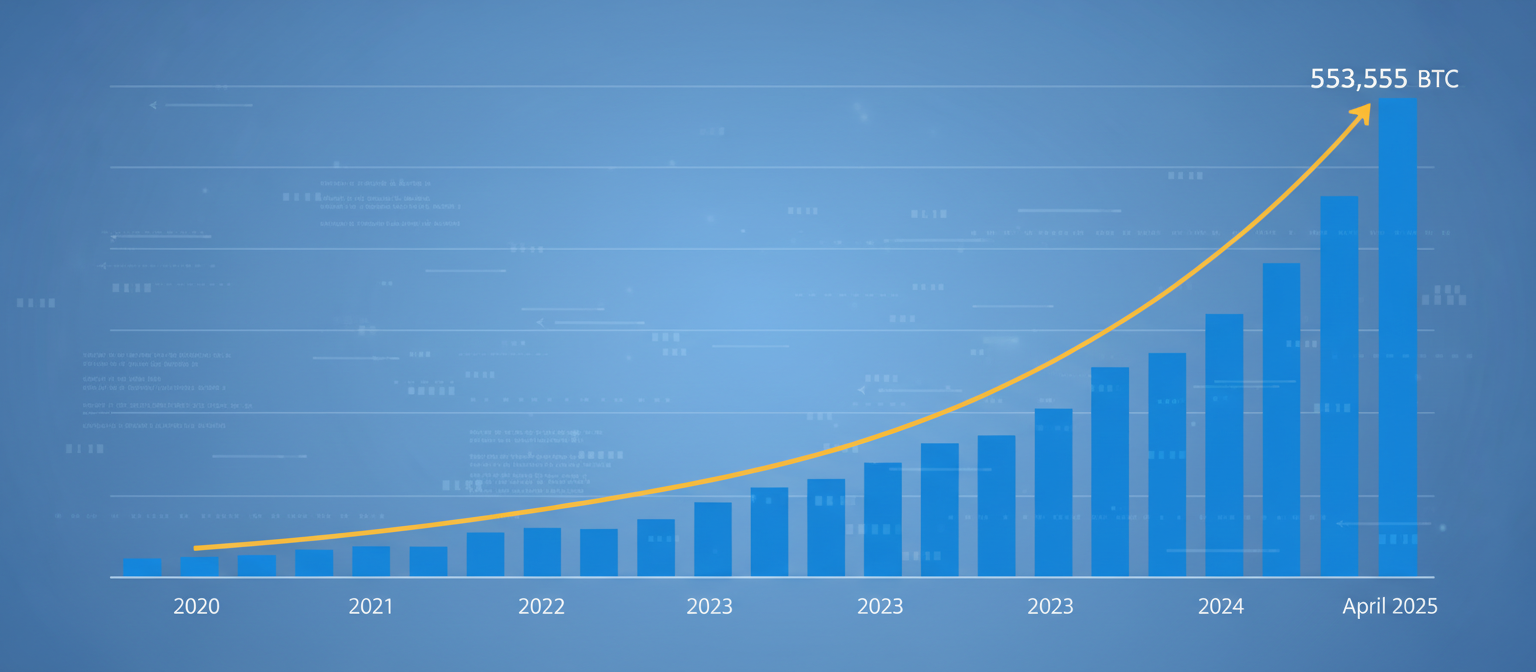

The announcement comes as institutional Bitcoin accumulation continues unabated. MicroStrategy disclosed on April 28 that it purchased an additional 15,355 BTC for approximately 1.42 billion dollars between April 21 and April 27, bringing the company’s total holdings to 553,555 Bitcoin acquired for 37.90 billion dollars at an average price of 68,459 dollars per coin. The purchase—MicroStrategy’s largest single April acquisition—signals continued corporate confidence in Bitcoin despite ongoing regulatory uncertainty in other jurisdictions.

The Regulatory Framework: What Changes

The draft legislation creates five new regulated activities that will require FCA authorization:

Stablecoin Issuance: Only UK issuers of “qualifying stablecoins” will be subject to the regime, with detailed rules on backing assets, redemption procedures, and interest payments to be determined by the FCA in subsequent consultations.

Dealing in Qualifying Cryptoassets: Firms that buy or sell cryptocurrencies as principals or agents must obtain authorization, bringing crypto dealers under the same regulatory framework as traditional securities dealers.

Custody Arrangements: Companies providing custodial wallet services—storing cryptocurrencies on behalf of clients—will need explicit authorization and must meet operational resilience and consumer protection standards.

Operating Trading Platforms: Cryptocurrency exchanges that facilitate trading between users will become regulated entities, similar to how traditional stock exchanges operate under FCA oversight.

Arranging Crypto Transactions: Firms that arrange or facilitate cryptocurrency transactions without directly dealing will also require authorization.

Importantly, the legislation excludes “truly decentralized” finance models from the authorization requirement, though it doesn’t provide clear criteria for what constitutes genuine decentralization versus centralized services marketed as decentralized. This ambiguity will likely become a key area of regulatory interpretation and potential dispute as the rules take effect.

The framework also carves out overseas firms that deal exclusively with UK institutional clients, recognizing that sophisticated investors require less retail protection. However, any firm targeting UK retail consumers—regardless of where the company is incorporated—will fall under FCA jurisdiction.

Implementation Timeline and Industry Transition

HM Treasury indicated it intends to finalize legislation by year-end 2025, with a phased implementation approach designed to give existing firms time to achieve compliance:

Phase One (late 2025): Parliament passes the legislation, granting rulemaking authority to the FCA and establishing the basic regulatory framework.

Phase Two (early 2026): The FCA begins accepting authorization applications and publishes detailed rules on specific requirements for capital adequacy, operational resilience, consumer protection, and disclosure.

Phase Three (throughout 2026): A transitional period during which existing crypto firms must either obtain authorization or wind down UK-facing operations. Firms operating without authorization after the transition deadline will face enforcement action.

The FCA published discussion paper DP25/1 on May 2 soliciting industry input on how specific rules should be structured, with a consultation deadline of June 13. This represents one of the few opportunities for crypto firms to influence the detailed requirements before they become binding.

The consultation will address unresolved questions including capital requirements for different types of crypto firms, standards for proof-of-reserves and attestation, specific operational resilience requirements for handling outages and cyber events, and consumer redress mechanisms when exchanges fail or assets are lost.

Consumer Protection at the Core

The regulatory push reflects mounting concern about retail investor exposure to fraud, insolvency, and operational failures in the crypto sector. While the draft legislation doesn’t specify detailed consumer protection requirements—those will come through FCA rulemaking—the framework establishes several key principles:

Transparency: Crypto firms must provide clear, accurate information about risks, fees, and the nature of digital assets. This likely means detailed disclosures about volatility, lack of deposit insurance, and the potential for total loss.

Operational Resilience: Exchanges and custodians must demonstrate robust systems to handle technical outages, cyber attacks, and unexpected volume spikes without compromising customer assets or data. The requirement responds to numerous high-profile exchange failures where inadequate infrastructure led to customer losses.

Capital Requirements: While specifics remain to be determined, regulated crypto firms will almost certainly face minimum capital thresholds to ensure they can absorb losses and continue operating during market stress without immediately failing.

Segregation of Assets: Custodians will likely be required to segregate customer assets from corporate funds, preventing the commingling that enabled FTX and other failed exchanges to misuse customer deposits.

Chancellor Reeves emphasized the consumer protection imperative: “We are making Britain the best place in the world to innovate—and the safest place for consumers.” The dual mandate—encouraging innovation while protecting retail investors—creates inherent tension that regulators will need to navigate carefully.

Global Regulatory Context

The UK framework arrives amid a global regulatory reckoning for cryptocurrency. Major jurisdictions are converging on similar approaches, though with significant variations in timing and specifics:

European Union: The Markets in Crypto-Assets Regulation (MiCA) took effect in phases throughout 2024 and early 2025, creating a comprehensive EU-wide framework for crypto regulation. The UK’s approach deliberately mirrors aspects of MiCA while tailoring requirements to British legal structures and regulatory philosophy.

United States: Regulatory clarity remains elusive, with the SEC and CFTC offering conflicting jurisdictional claims and enforcement approaches. Some industry participants view the UK’s clear framework as a competitive advantage that could attract crypto firms frustrated by US regulatory uncertainty.

Singapore and Hong Kong: Both Asian financial centers have implemented licensing regimes for crypto exchanges and service providers, positioning themselves as crypto-friendly hubs with strong consumer protections.

The UK’s decision to proceed with comprehensive regulation—rather than waiting for international coordination—reflects confidence that clear rules will attract legitimate crypto businesses while deterring bad actors. Whether that bet proves correct will depend heavily on how burdensome the detailed FCA requirements turn out to be.

MicroStrategy’s Continued Accumulation

While regulators work to establish frameworks for retail participation, institutional investors continue deploying substantial capital into Bitcoin. MicroStrategy’s April 21-27 purchase of 15,355 BTC for 1.42 billion dollars at an average price of 92,737 dollars represents the company’s largest single April acquisition.

Executive Chairman Michael Saylor announced the purchase on April 28, continuing the aggressive accumulation strategy that has defined the company since it began buying Bitcoin in August 2020. MicroStrategy’s total holdings now stand at 553,555 BTC acquired for approximately 37.90 billion dollars—an average cost basis of 68,459 dollars per coin.

At Bitcoin’s current price around 91,700 dollars, MicroStrategy’s holdings show an unrealized gain of approximately 12.87 billion dollars, demonstrating the profitability of the long-term accumulation approach despite Bitcoin’s significant volatility over the period.

The company reported a year-to-date BTC yield of 13.7 percent for 2025, a metric that measures how much Bitcoin per share has increased relative to share count. The yield reflects MicroStrategy’s ability to acquire Bitcoin faster than it dilutes existing shareholders through equity and debt raises—a key performance indicator for the strategy’s effectiveness.

MicroStrategy’s purchases are part of its “21/21 Plan” announced earlier this year, which aims to raise 42 billion dollars (21 billion through equity, 21 billion through debt) to fund Bitcoin acquisitions. The April purchase suggests the company is making steady progress toward that ambitious capital-raising goal.

The Institutional-Retail Divergence

The contrast between the UK’s regulatory announcement and MicroStrategy’s continued accumulation highlights a growing divergence in how institutional and retail participants interact with cryptocurrency markets.

Institutions like MicroStrategy, with sophisticated treasury management, legal resources, and risk frameworks, can navigate regulatory uncertainty and custody solutions that remain inaccessible or impractical for retail investors. They custody Bitcoin through specialized institutional providers, implement multi-signature security protocols, and structure holdings to comply with accounting and tax requirements.

Retail investors, by contrast, often rely on centralized exchanges that provide user-friendly interfaces but introduce counterparty risk, operational vulnerabilities, and exposure to fraud. The UK’s regulatory framework attempts to narrow this gap by imposing institutional-grade requirements on firms serving retail customers.

Whether regulation successfully protects retail investors without stifling innovation or driving activity to less-regulated jurisdictions remains the central question. Overly burdensome rules could push crypto activity offshore or underground; insufficiently rigorous oversight could leave consumers vulnerable to the same failures that have plagued the industry.

Market Reaction and Forward Look

Bitcoin traded relatively flat following both the UK regulatory announcement and MicroStrategy’s disclosure, suggesting markets had largely priced in both developments. The cryptocurrency currently trades around 91,700 dollars—well above the lows reached during Q1’s tariff-driven selloff but still roughly 16 percent below the January all-time high of 109,000 dollars.

The muted market reaction reflects growing maturity: regulatory frameworks and large institutional purchases have become routine rather than market-moving events. Bitcoin’s price trajectory depends increasingly on macroeconomic factors—interest rates, inflation, risk appetite—rather than crypto-specific developments.

For the UK crypto industry, the coming weeks will focus on responding to the FCA’s consultation and attempting to influence the detailed rules that will govern operations. Industry associations will likely advocate for proportionate capital requirements, clear safe harbors for compliance, and avoiding gold-plating requirements beyond what other major jurisdictions impose.

Key concerns for crypto firms include:

Capital Requirements: If set too high, capital thresholds could exclude smaller innovative firms or force consolidation around large, established players.

Custody Standards: Overly prescriptive custody requirements might mandate expensive infrastructure that provides marginal security improvements over current best practices.

Stablecoin Rules: Depending on how the FCA defines eligible backing assets and redemption procedures, UK stablecoin issuance could become either highly attractive or effectively prohibited.

Decentralization Criteria: The lack of clear standards for “truly decentralized” systems creates uncertainty about which business models remain outside regulatory scope.

Looking Ahead

The UK’s move to comprehensive crypto regulation represents a significant milestone in digital assets’ evolution from frontier technology to mainstream financial infrastructure. By establishing clear rules, Britain aims to capture the economic benefits of crypto innovation while protecting consumers from the sector’s well-documented risks.

Success will require threading a difficult needle: rules stringent enough to prevent fraud and operational failures, but not so burdensome they drive crypto businesses to more permissive jurisdictions. The detailed requirements the FCA develops over the coming months will determine whether the UK achieves that balance.

For Bitcoin and the broader crypto market, regulatory clarity in major financial centers like the UK removes a source of uncertainty that has periodically triggered selloffs. Clear rules allow firms to plan, investors to assess risks, and innovation to proceed within defined boundaries.

As April closes with Bitcoin hovering in the low 90,000-dollar range, the cryptocurrency faces a relatively calm period compared to Q1’s volatility. MicroStrategy’s continued accumulation signals institutional conviction that Bitcoin’s long-term value proposition remains intact regardless of short-term regulatory developments.

The UK framework, MicroStrategy’s purchases, and Bitcoin’s price stability suggest an asset class maturing—transitioning from pure speculation to integration with traditional finance, complete with the regulatory oversight that accompanies legitimacy.

This article reflects market conditions and regulatory developments as of April 30, 2025.