America’s largest banking institutions are reportedly exploring a groundbreaking collaboration to develop a joint stablecoin, marking what could be a pivotal moment in the integration of traditional finance and cryptocurrency. According to reports from The Wall Street Journal, major banks including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are in early discussions about creating a unified digital currency for interbank transactions.

The potential consortium represents a remarkable shift in attitude from traditional banking institutions, which have historically maintained cautious or skeptical positions toward cryptocurrency adoption. This exploration of a joint stablecoin comes amid growing regulatory clarity and increasing institutional acceptance of digital assets under the current administration.

The Banking Consortium: A New Era of Collaboration

The reported discussions involve some of the most influential banking institutions in the United States, suggesting serious consideration of cryptocurrency integration at the highest levels of traditional finance. The consortium approach would allow these banks to leverage their combined resources, regulatory expertise, and market reach to create a stablecoin that could compete effectively with existing digital payment solutions.

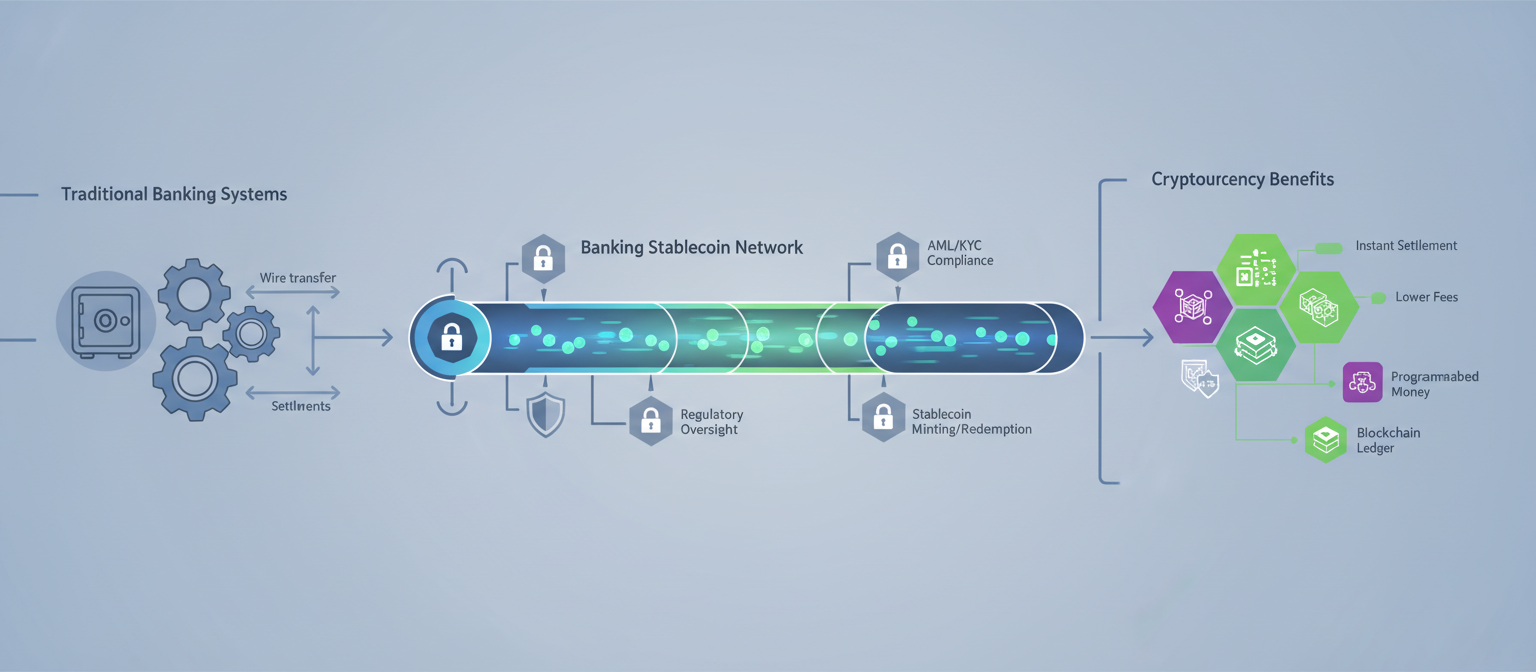

The collaboration would reportedly utilize existing banking infrastructure and relationships, potentially involving companies co-owned by the participating banks through established financial networks like The Clearing House and Early Warning Services. This approach would allow the consortium to build upon proven payment systems while introducing cryptocurrency benefits like faster settlement times and reduced transaction costs.

“The fact that these major banks are even discussing a joint stablecoin represents a fundamental shift in how traditional finance views digital assets,” noted Michael Thompson, managing director at Boston Consulting Group’s financial services practice. “This isn’t just one bank exploring cryptocurrency—it’s a coordinated effort by the institutions that form the backbone of the U.S. financial system.”

Stablecoin Technology Meets Banking Infrastructure

A bank-backed stablecoin would combine the technological advantages of cryptocurrency with the regulatory compliance and stability of traditional banking. Unlike existing stablecoins issued by cryptocurrency companies, a bank consortium stablecoin would benefit from:

Full Regulatory Compliance: Backed by regulated banking institutions with established anti-money laundering (AML) and know-your-customer (KYC) procedures

Direct Fiat Integration: Seamless connection to existing banking systems and Federal Reserve payment networks

Enhanced Transparency: Regular audits and reporting under existing banking regulatory frameworks

Systemic Trust: Backed by the collective creditworthiness of America’s largest banks

The proposed stablecoin would likely be pegged to the U.S. dollar, maintaining price stability while enabling the instant settlement and programmability features that make cryptocurrency attractive for financial applications. This approach could significantly improve the efficiency of interbank transfers, cross-border payments, and other banking operations.

Strategic Implications for the Banking Industry

The exploration of a joint stablecoin reflects several strategic considerations by major banking institutions:

Competitive Response: Banks recognize the threat posed by fintech companies and cryptocurrency platforms that have captured significant market share in payments and remittances

Cost Reduction: Stablecoin technology could dramatically reduce the costs associated with traditional interbank settlements and cross-border transfers

Future-Proofing: Positioning traditional banks for the ongoing digitalization of financial services and potential central bank digital currency (CBDC) developments

Customer Demand: Responding to increasing customer expectations for faster, cheaper, and more technologically sophisticated financial services

“This isn’t just about creating a new product—it’s about ensuring that traditional banking remains relevant in an increasingly digital financial ecosystem,” explained Sarah Rodriguez, senior analyst at Forrester Research. “Banks recognize that they need to adapt to changing technology and customer expectations, and stablecoin technology offers a way to do that while maintaining their core banking values.”

Potential Use Cases and Market Impact

A bank-backed stablecoin could revolutionize various aspects of banking operations and financial services:

Interbank Settlements: Dramatically reducing the time and cost associated with overnight clearing and settlement processes

Cross-Border Payments: Enabling faster and cheaper international transfers compared to traditional correspondent banking networks

Commercial Banking: Providing large corporate clients with more efficient treasury management and payment solutions

Retail Banking: Potentially offering consumers new digital payment options with the backing of traditional banking institutions

The market impact could be substantial, potentially challenging existing stablecoin issuers like Circle (USDC) and Tether (USDT) while creating new competitive dynamics in the digital payments space. The banking consortium’s established customer base, regulatory compliance, and financial resources could provide significant advantages in the stablecoin market.

Regulatory and Operational Challenges

Despite the promising potential, the banking consortium faces several significant challenges:

Regulatory Approval: The project would require approval from multiple banking regulators, including the Federal Reserve, OCC, and FDIC

Technical Integration: Integrating cryptocurrency technology with existing banking infrastructure presents complex technical challenges

Competitive Concerns: Regulators may scrutinize the collaboration for potential antitrust implications

Risk Management: Banks would need to develop new risk management frameworks for cryptocurrency-related operations

“The regulatory hurdles for this project cannot be overstated,” warned regulatory consultant James Harrington. “Banks operate under extensive regulatory oversight, and introducing cryptocurrency technology into that environment raises novel legal and compliance questions that will need careful consideration from multiple regulatory agencies.”

Timeline and Next Steps

According to sources familiar with the discussions, the banking consortium remains in early, conceptual stages, and significant work remains before any stablecoin could be launched. The timeline for potential implementation remains uncertain, with experts suggesting that regulatory approval and technical development could take several years.

However, the fact that these discussions are occurring at all represents significant progress for cryptocurrency adoption within traditional finance. The banking industry’s growing willingness to explore digital asset solutions reflects the broader trend of institutional acceptance and integration of cryptocurrency technology into mainstream financial services.

As the discussions progress, the banking consortium will likely engage with regulators, technology partners, and other stakeholders to address the various technical, legal, and operational challenges associated with launching a bank-backed stablecoin. The success or failure of this initiative could have far-reaching implications for the future of both traditional banking and cryptocurrency markets.

For cryptocurrency enthusiasts and traditional banking customers alike, the prospect of major banks collaborating on a stablecoin represents an exciting convergence of two financial worlds that have often seemed at odds. Whether this potential collaboration leads to a finished product remains to be seen, but it undoubtedly signals a new chapter in the evolution of digital finance.

This article reflects information available as of May 23, 2025. Banking discussions and regulatory developments may have evolved since publication.