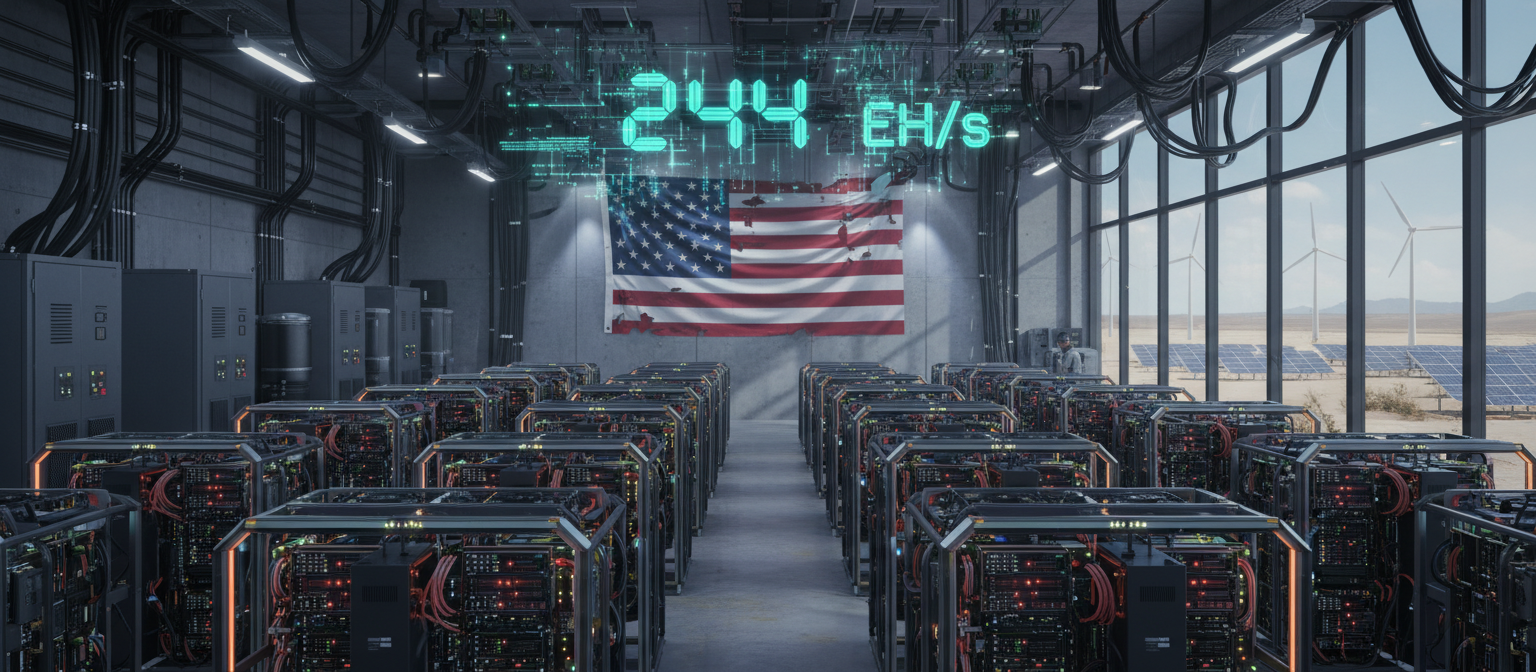

U.S.-listed Bitcoin mining companies have dramatically expanded their dominance over the global Bitcoin network, now controlling an unprecedented 29% of total hashrate according to a groundbreaking JPMorgan report released February 18. The surge represents a 95% year-over-year increase in hashrate controlled by American publicly-traded miners, reaching 244 EH/s as institutional mining operations continue consolidating power in the evolving cryptocurrency landscape.

The remarkable growth in U.S. mining dominance comes despite challenging market conditions, with Bitcoin prices declining approximately 20% from January highs and mining profitability dropping 13% over the same period. The expansion demonstrates how institutional-scale mining operations with access to capital markets and sophisticated operational strategies can continue growing hashrate even during market downturns, potentially reshaping Bitcoin’s geographical distribution and security model for years to come.

Institutional Capital Drives Hashrate Expansion

The explosive growth in U.S. mining hashrate reflects a fundamental shift in the industry’s capital structure, with publicly-traded companies leveraging stock market valuations and institutional investment to fund massive expansion projects. Companies like Marathon Digital, Riot Platforms, CleanSpark, and others have raised billions through equity offerings and convertible notes, enabling them to purchase next-generation mining hardware and secure long-term power contracts at scales unavailable to private operators.

This institutional approach contrasts sharply with the early Bitcoin mining era, when individual hobbyists and small operations dominated network security. Today’s mining giants operate with corporate governance structures, professional management teams, and sophisticated treasury strategies that allow them to weather market volatility while maintaining aggressive expansion plans. The ability to access public markets provides crucial advantages during difficult mining periods, when private operators might be forced to sell equipment or shut down operations.

The JPMorgan report highlights that U.S. miners’ strategic advantages extend beyond capital access. These companies benefit from operating in jurisdictions with relatively stable regulatory frameworks, access to sophisticated financial services, and the ability to negotiate favorable terms with energy providers. The combination of institutional backing and operational expertise has created a virtuous cycle where larger operations can achieve economies of scale that smaller competitors cannot match.

Geographical Concentration Raises Security Questions

The growing dominance of U.S.-listed miners in Bitcoin’s security model has sparked important discussions about network decentralization and geographic concentration. While Bitcoin was designed to be a globally distributed network resistant to censorship and single-point failures, the increasing concentration of hashrate within U.S. jurisdictions and under corporate control represents a significant shift from the network’s original decentralization ethos.

Security experts note that the 29% figure actually understates U.S. influence, as it only includes publicly-traded companies and doesn’t account for private U.S. mining operations or mining facilities controlled by U.S. companies in other jurisdictions. The actual U.S. share of global hashrate likely exceeds 40% when all American-controlled operations are considered, creating a substantial geographic concentration that could theoretically be subject to regulatory pressure or government intervention.

However, supporters of institutional mining argue that publicly-traded companies actually enhance network security through professional operations, redundancy, and regulatory compliance. Unlike anonymous mining operators, public companies face disclosure requirements and shareholder oversight that makes their operations more transparent and accountable. The institutionalization of mining may also reduce the risk of individual state actors attempting to attack the network, as corporate mining operations have diverse shareholder bases and legal obligations to multiple stakeholders.

Mining Profitability Challenges Amid Expansion

Despite impressive hashrate growth, U.S. miners face significant profitability challenges that test their institutional advantages. The 13% decline in mining profitability since January reflects the combined impact of lower Bitcoin prices and increasing network difficulty. As more hashrate comes online globally, the competition for block rewards intensifies, making efficient operations and low-cost energy increasingly critical for survival.

U.S. mining companies have responded to these challenges through several strategic initiatives. Many have diversified their revenue streams by offering hosting services to other mining operations, effectively monetizing their infrastructure and expertise. Others have begun exploring high-performance computing and artificial intelligence applications for their mining facilities, creating alternative revenue sources that can complement or supplement Bitcoin mining during periods of low profitability.

The most successful U.S. miners have secured long-term power contracts at favorable rates, often tied to renewable energy sources that provide both cost advantages and environmental, social, and governance (ESG) benefits. These power arrangements, combined with next-generation mining hardware that offers superior efficiency, give institutional miners significant operational advantages over smaller competitors who must purchase power on spot markets or use older, less efficient equipment.

Regulatory Landscape Favors U.S. Operations

The expansion of U.S. mining dominance coincides with a evolving regulatory environment that appears increasingly favorable to cryptocurrency operations. The Trump administration’s pro-crypto stance, combined with state-level initiatives to create cryptocurrency-friendly regulations, has created a more predictable operating environment for U.S. mining companies compared to many other jurisdictions.

Regulatory clarity allows mining companies to make long-term investment decisions with greater confidence, secure financing on more favorable terms, and attract institutional investors who might otherwise be wary of regulatory uncertainty. The ability to operate within established legal frameworks also makes it easier for mining companies to form partnerships with traditional energy providers and financial institutions, further strengthening their competitive position.

However, the regulatory environment remains complex, with mining companies navigating overlapping federal and state regulations, environmental compliance requirements, and increasing scrutiny of energy consumption. The most successful U.S. miners have invested heavily in compliance teams and environmental monitoring systems, turning regulatory compliance into a competitive advantage that smaller operators struggle to match.

Technological Innovation and Infrastructure Investment

The institutionalization of Bitcoin mining has accelerated technological innovation in the sector, with U.S. companies leading development of more efficient mining hardware, sophisticated cooling systems, and advanced facility management platforms. These investments in technology and infrastructure help explain how U.S. miners can continue expanding hashrate even as profitability declines.

Leading U.S. mining companies are deploying next-generation ASIC miners that offer significantly improved energy efficiency compared to previous generations. These hardware upgrades, combined with optimized facility designs and advanced cooling systems, allow institutional miners to achieve lower cost per bitcoin than many competitors. The ability to rapidly deploy new hardware at scale represents a crucial advantage in the competitive mining landscape.

Beyond hardware, U.S. miners are investing in sophisticated software systems for monitoring and optimizing mining operations. These systems use artificial intelligence and machine learning algorithms to maximize mining efficiency, predict hardware failures, and optimize power consumption across entire mining fleets. The institutional approach to mining operations increasingly resembles traditional data center management, with professional teams overseeing complex technical infrastructure.

Market Implications and Future Outlook

The growing dominance of U.S. institutional miners has significant implications for Bitcoin’s broader market dynamics. As more hashrate concentrates within publicly-traded companies, Bitcoin’s security model becomes increasingly tied to traditional financial markets and regulatory frameworks. This integration could enhance Bitcoin’s legitimacy among institutional investors while potentially reducing its appeal among cypherpunks and decentralization advocates.

The institutionalization of mining also affects Bitcoin’s supply dynamics. Professional mining operations tend to be more disciplined about selling Bitcoin holdings, often implementing sophisticated treasury strategies rather than immediately selling all mined coins. This approach could reduce selling pressure on Bitcoin markets, potentially supporting prices during periods of increased hashrate and mining difficulty.

Looking forward, the trend toward institutional mining consolidation appears likely to continue. The advantages of public market access, operational scale, and regulatory compliance create powerful competitive moats that favor established mining companies over new entrants. While smaller mining operations will likely continue to exist, their share of global hashrate may continue declining as institutional players expand their dominance.

For Bitcoin investors and users, the institutionalization of mining represents both opportunities and risks. On one hand, professional mining operations enhance network security and reliability while reducing the likelihood of individual bad actors disrupting the network. On the other hand, increasing geographic and corporate concentration introduces new systemic risks that could affect Bitcoin’s censorship resistance and decentralization properties.

This article reflects mining industry data and analysis available as of February 15, 2025.